The LME I am referring to is not the London Metal Exchange, although there is a nice bull market taking place in a number of commodities. Rather, LME is referencing liability management exercises, in which public and private companies decide their overleveraged capital structures will be unsuccessful, and the best way to reduce debt in lieu of bankruptcy is to engage in coercive exchanges with creditors. Liability management sounds benign, but it’s often a prelude to bond haircuts and/or removing covenants or collateral. The exercises include drop downs, priming and non-pro rata uptiering transactions. It is interesting as it seems quite prevalent now, occurring in a strong credit market with spreads near all-time tights. In these markets, we typically see more straightforward actions such as dividend deals and leveraged recaps — good old-fashioned shareholder-friendly activity that may cause some anxiety for bondholders and the occasional ratings downgrade but don’t pose an immediate existential threat.

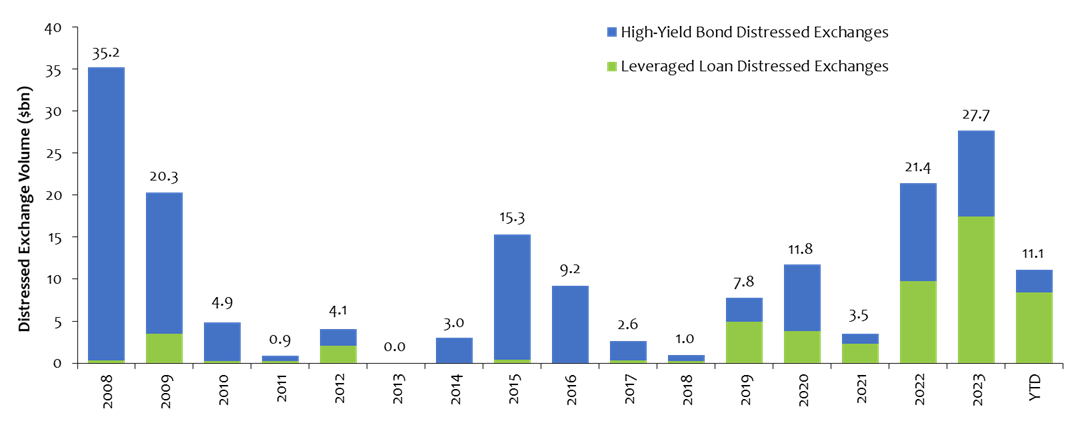

Despite low and projected default rates, distressed exchanges in the first quarter 0f 2024 were the fourth-largest quarterly total on record, according to J.P.Morgan.1 The current market features a number of high-profile and large index issuers, such as DISH Network Corporation, Ardagh Group, CommScope, Altice USA, Level 3 Communications and Bausch Health, that may engage or have engaged in LME. The Bloomberg article titled, “Credit-Market Clashes are Getting Uglier, Dirtier and More Common,” identified the trend of adverse creditor-on-creditor and creditor versus sponsor/company situations.2 The article specifically referenced aggressive actions in the J. Crew, Envision Healthcare and Serata Capital Partners structures. Two years later, the aforementioned has been proven to be accurate, and the higher-for-longer interest rate scenario will likely result in more of these situations.

Key Takeaway

Participating in credits where LME is about to occur or has occurred requires a great deal of patience, a tolerance of volatility, a willingness to invest new money and a long-term time horizon. There may be a tradeoff when deciding to engage — similar to a football coach on the cusp of a playoff spot, advising the owner on free agents and focusing on the current year or stockpiling future draft picks in the hopes of a Super Bowl win down the road. Both are viable strategies. The issue with the latter is that if current performance is bad, the coach might not be employed to enjoy the payoff.

Sources:

1J.P.Morgan

2Bloomberg – Credit-Market Clashes are Getting Uglier, Dirtier and More Common; 5/10/22

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.