It’s Nvidia’s World, and We’re Just Living In It

February 29, 2024

.png)

Nvidia has become the most topical name in the investing world. Last week, Goldman Sachs called Nvidia "the most important stock on planet earth" ahead of its hugely anticipated fourth-quarter earnings report.1 Nvidia and the well-known Magnificent Seven do not just move the needle when it comes to movement in the stock market indices, they have become the needle.

Nvidia earnings surpassed expectations last week, and the stock rose approximately 16% to a record-high close and added $277 billion in stock market value — the largest one-day gain in Wall Street history.2 Nvidia's market cap has nearly surpassed the size of Canada's economy, and it took only eight months for Nvidia's market cap to go from $1 trillion to $2 trillion, less than half the time it took Apple and Microsoft.3 Simply put, we are witnessing history.

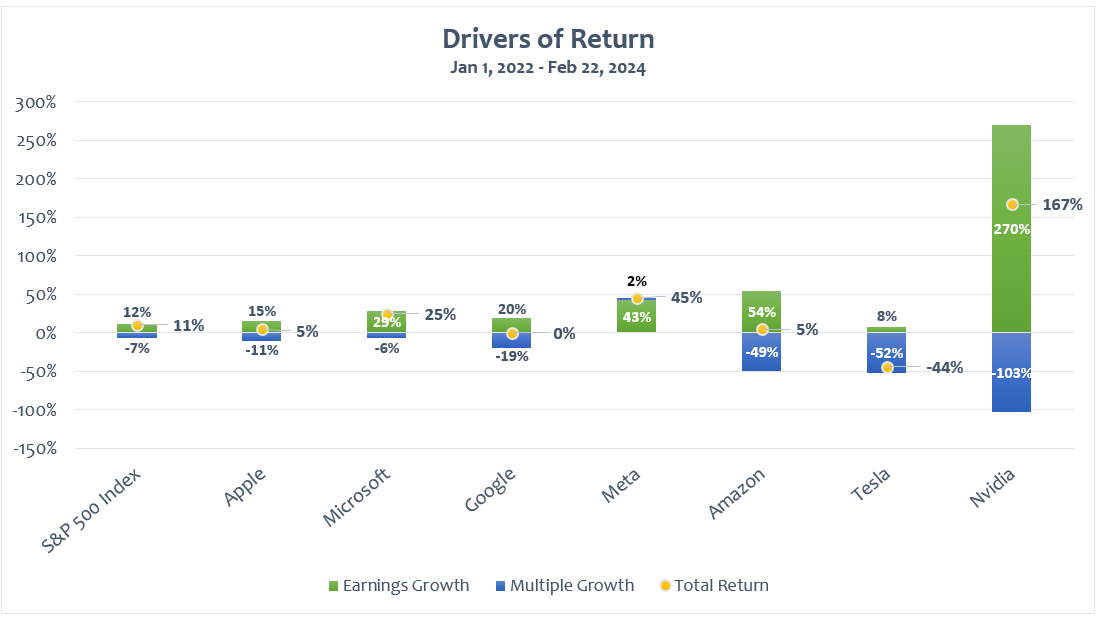

Nvidia's stock price moves are not just “all bark with no bite.” They are justified through performance as price moves are supported by earnings growth. Nvidia’s fourth-quarter sales more than tripled compared to a year ago, with every segment beating expectations, and net profit increased 872%.4 Today’s Chart of the Week shows Nvidia's earnings have grown 270% over the past two years while its multiple has decreased 103%. This scenario indicates that increases in Nvidia's stock price have been driven by earnings growth, not valuation. Nvidia's 5-year average price-to-earnings ratio (P/E) is 95x, which is higher than the current 65x post-earnings, implying that Nvidia is growing into its valuation.5 Every time Nvidia reports earnings, the P/E shrinks due to earnings being stronger than anticipated.

Unlike the dot-com bubble, valuations today aren’t as extreme as witnessed during the bubble’s peak. During a bubble, assets typically trade at a price that greatly exceeds the asset's intrinsic value. As a result, the price does not align with the fundamentals of the asset. In this case, Nvidia is highly valued and the fundamentals are strong as well — thus likely not a bubble. Nvidia’s current valuation is low compared to the earnings multiple companies like Cisco were fetching during the peak of the dot-com boom. Nvidia’s current forward P/E is 32x,6 while Cisco was valued at a multiple of more than 150x forward earnings in March 2000.7 This would show a larger mispricing due to higher valuations not supported by fundamentals during the dot-com period compared to today. Additionally, the P/E ratio for the 10 biggest companies hit 41x at its dot-com peak, yet the P/E ratio for the 10 biggest companies today is around 27x.8 The dot-com bubble eventually burst when valuations clearly were no longer supported by earnings, causing a crash and the beginning of a bear market.

Key Takeaway

Since the start of 2022, the Magnificent Seven — led by Nvidia — have experienced multiple compressions yielding gains in stock price driven by profit growth. This is quite different from the dot-com bubble, where returns were largely driven by multiple growth, not profit. Nvidia’s shares have skyrocketed, but the company’s profits have risen even faster. Currently, it does not appear that the market has gotten ahead of itself and mispriced Nvidia or the other Magnificent Seven, as their equity returns seem warranted and supported by earnings growth.

Sources:

1Bloomberg – Goldman’s Trading Desk Calls Nvidia ‘Most Important Stock’ on Earth; 2/21/24

2Reuters – Nvidia adds record $277 billion in stock market value; 2/23/24

3Yahoo! Finance – Chipmaker Nvidia is worth nearly as much as the entire Canadian economy. Here's why; 2/24/24

4Carson Investment Research – NVIDIA’s Blockbuster Earnings All About the Supply/Demand Imbalances for AI; 2/23/24

5,6Bloomberg

7Morningstar – Wall Street keeps likening Nvidia to dot-com-era Cisco. Is the comparison justified?; 2/21/24

8Fast Company – Repeat after me: It’s not a bubble; 2/7/24

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.