Highly (Interest Rate) Sensitive

June 13, 2024

Small capitalization companies are underperforming this year. The Russell 2000 Index, a commonly used index to track small-cap stocks, is up 2.5% year-to-date as of 6/12/2024, while the S&P 500 Index is up 14.0% over the same period. This year’s underperformance continues a multi-year-long trend of relative small-cap weakness, forming a significant valuation gap between small and large caps. The Russell 2000 Index’s price-to-sales ratio (P/S) of 1.3x is the lowest in nearly 20 years relative to the S&P 500 Index’s P/S ratio of 2.8x (excluding the bottoming out during the COVID-19 pandemic in 2020).1

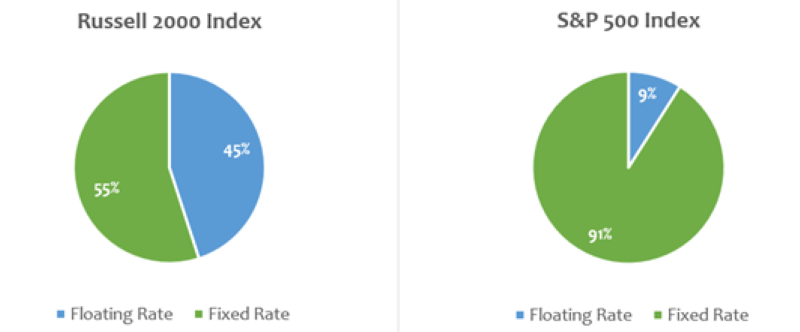

Small-cap companies generally tend to use more debt, borrow at higher rates and borrow for shorter periods of time than large-cap companies. Additionally, they often have to use more floating-rate debt than larger companies.2 As seen in today’s Chart of the Week, floating-rate debt accounts for 45% of aggregated Russell 2000 Index debt compared to 9% of the S&P 500 Index debt.3 This substantial disparity between the two indexes can help explain the significant small-cap underperformance in a higher interest rate environment. The Federal Reserve’s higher for longer rate outlook is disproportionately hurting smaller companies.

On average, small caps have more debt; however, this debt is concentrated amongst a small percentage of companies. Half of the Russell 2000 Index’s debt is held by 10% of its constituents, and 33% of Russell 2000 companies have net cash, compared to 13% of S&P 500 companies.4 Debt may be a significant issue for many small-cap companies, but it is not an issue for all. In my opinion, there is still an opportunity for investors who can be selective and are able to identify these undervalued companies with healthy balance sheets.

Key Takeaway

Many small-cap companies are much more interest rate sensitive compared to larger companies. Their use of greater leverage with more floating-rate debt in a persistently high interest rate environment is keeping investors from buying broadly. Due to their interest rate sensitivity, the delay in rate cuts has inhibited an awaited rally in small-cap stocks but could possibly enable some large benefits once rates decline.

Sources:

1Bloomberg - A $600 Billion Wall of Debt Looms Over Market’s Riskiest Stocks; 5/11/24

2,4Wellington Management - A turning point for US small caps; April 2024

3Lazard Asset Management - Small Caps Poised to Make Big Moves?; 12/4/23

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.