Increase in the Use of Subscription Lines — Considerations for Limited Partners

June 20, 2024

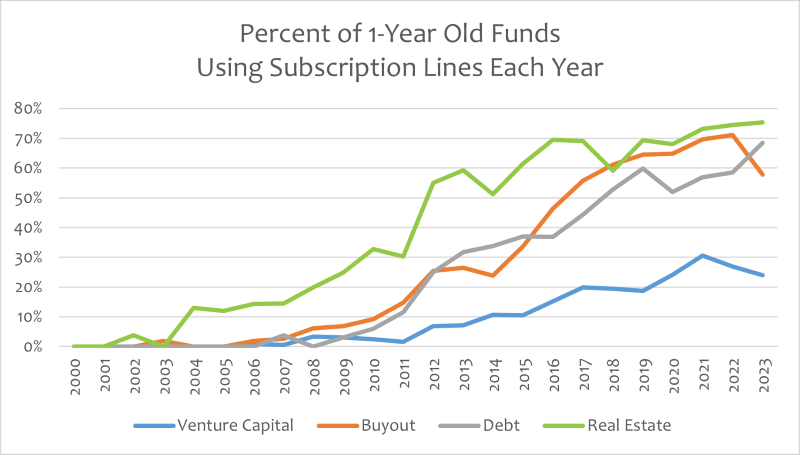

Subscription lines, also referred to as capital call facilities, are revolving credit facilities secured by the undrawn limited partner (LP) capital commitments and must be repaid over a defined period. Although these facilities are now an established fixture of private equity funds across asset classes, their use has broadened over the last 15 years — as illustrated in today’s Chart of the Week. As a portfolio management tool, subscription lines effectively reduce the administrative burden for general partners (GP) and LPs alike. Subscription lines allow GPs to bridge the gap between the time they make a portfolio investment and the actual time required for the corresponding capital call to be sent out to and funded by LPs, and serve as a way for GPs to delay the drawdown of such capital for a longer period of time.

The prevalence of subscription lines, their size and the time to repay them all increased rapidly between 2005 and 2021, driven partly by the low post-Global Financial Crisis interest rate environment. With the exception of buyouts and venture capital, whose utilization of subscription lines has dipped over the last few years due in part to higher borrowing costs, the use of these lines of credit continues to rise to record levels for other investment strategies. While these loans typically remain outstanding for 90 days, on average, terms have trended more aggressively over time — with maximum days outstanding for lines topping 360 days or longer for outlier users of capital call facilities.

Depending on how aggressively they are deployed, capital call facilities impact investor returns to varying degrees. First, the delay in drawing down capital from LPs effectively shortens their holding period. Assuming sufficiently positive performance, the internal rate of return (IRR) will increase moderately. According to BlackRock, on average, the impact on fund performance through the use of subscription lines affected IRR by +0.5 percentage points.1 Second, the interest paid on the subscription lines marginally reduces the net returns of the fund (by -0.02x, on average),2 leading to a lower multiple of invested capital (MOIC) than the fund would have had if a subscription line was not utilized. Third, if the performance of the underlying investment is negative, the use of leverage will amplify its impact. While these potential results may not seem material on the surface, they do create issues for LPs when they attempt to compare the performance of one fund to that of another — especially when it is not clear if subscription lines have been utilized by the funds being analyzed and to what extent.

Given the growth in the relevance of subscription lines and the lack of standardization and clarity around the portfolio management tool, Institutional Limited Partners Association (ILPA) has written extensively on the subject. While ILPA recognizes that there are valid and beneficial uses of subscription lines that help both GPs and LPs — not least being the smoothing of cash flows and the flattening of the J-curve — they have recommended that LPs push for limitations on subscription lines, such as a maximum percentage of uncalled capital of 15-25% and a maximum of 180 days outstanding on subscription lines. They have also pushed GPs for more standardized reporting and common disclosure norms, including the provision of returns both with and without the use of subscription lines.

Key Takeaway

While subscription lines offer GPs and LPs a number of benefits, they are not without risks. Subscription lines certainly enhance the flexibility and efficiency of private equity funds, but their impact on performance metrics like IRR and MOIC must be carefully considered. Using these credit lines introduces additional leverage into the fund, which can amplify risks if not managed properly. When looking at their current portfolios and considering new investments, LPs would do well to understand the extent to which managers utilize capital call facilities and the impact that these credit lines have had (or could have) on historical (or future) performance.

Sources:

1,2BlackRock – Understanding the impact of subscription lines on private equity funds; 2024

Definition:

The Institutional Limited Partners Association (ILPA) is a trade association for institutional limited partners in the private equity asset class. ILPA publishes a variety of industry guidance for LPs and GPs, including Principles 3.0, model LPAs and fund reporting templates.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.