Breaking Down Primary Market Volumes in the U.S. CLO Market

July 11, 2024

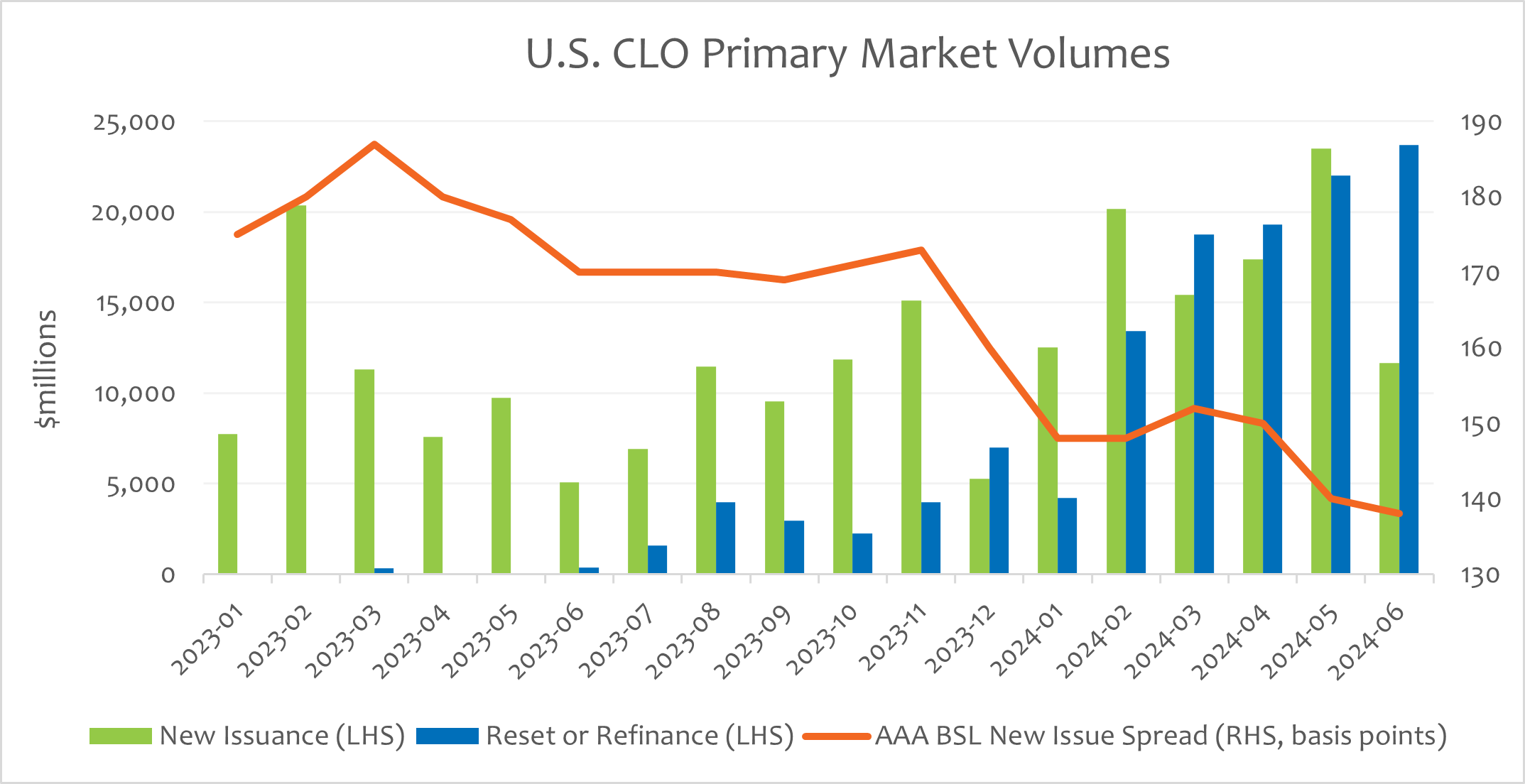

Volumes have surged in the U.S. collateralized loan obligation (CLO) primary market with $200 billion in gross supply for the first half of 2024.1 For comparison, 2022 and 2023 saw full-year primary market volumes of $152 billion and $145 billion, respectively.2 Despite rising primary volumes, spreads — commonly referred to as discount margin (DM) — on CLOs continued to tighten as the second quarter of 2024 came to a close.

Today’s Chart of the Week breaks down the supply of U.S. CLOs a bit further. Primary market supply of CLOs consists of new issuance, resets and refinances. Resets and refinances have negligible impact on the net supply of CLOs as they constitute a restructuring (reset) or repricing (refinancing) of an existing CLO. Approximately 50% of the gross supply of CLOs this year has been from reset and refinance activity, compared with 16% for 2023.3

The remaining $100 billion of CLO gross supply this year is from new issuance; however, the U.S. CLO market has grown in size by only $36 billion in 2024.4 Several factors have contributed to this difference. Approximately 40% of the CLO market exited the reinvestment period by the end of 2023, which has resulted in approximately $42 billion in amortization of existing CLO debt in 2024.5 Furthermore, $22 billion of CLO debt is estimated to have been called away from deals that were liquidated.6

Key Takeaway

CLO managers should continue to be incentivized by current AAA CLO spread levels to improve the funding costs and extend the reinvestment periods of their existing debt, which would keep call activity and reinvestment needs elevated for investors. Robust inflows into CLO exchange-traded funds (ETFs) this year from retail investors have created additional demand for CLOs as well. I believe our nimble, relative-value focused approach to fixed-income investing is crucial for navigating the current surge in primary market activity in the CLO market.

Sources:

1-6Bank of America Global Research; June 2024

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.