Credit Secondaries: A New Asset Class Takes Shape

July 18, 2024

The rise of credit secondaries has been garnering a lot of attention, driven by the remarkable growth of the private credit market and investor demand for alternative investment opportunities. Credit secondaries refers to the buying and selling of limited partner (LP) interests in credit funds or portfolios of loans on the secondary market, offering liquidity to investors needing to exit their positions before the maturity of the underlying assets.

Credit secondaries can either take the form of LP-led or general partner-led (GP-led) transactions. LP-led transactions involve investors initiating the sale of their interests in credit fund(s) on the secondary market. This allows LPs to gain liquidity and reallocate their capital to other investments, while buyers can acquire stakes in established funds with known portfolios.

In contrast, GP-led transactions involve the GP of a credit fund initiating a secondary market sale of assets, typically to provide liquidity to existing investors or to extend the holding period for assets they believe exhibit further upside. By facilitating GP-led secondary transactions, GPs can offer their investors the option to exit their investments earlier than originally planned, thereby enhancing the overall liquidity of the fund.

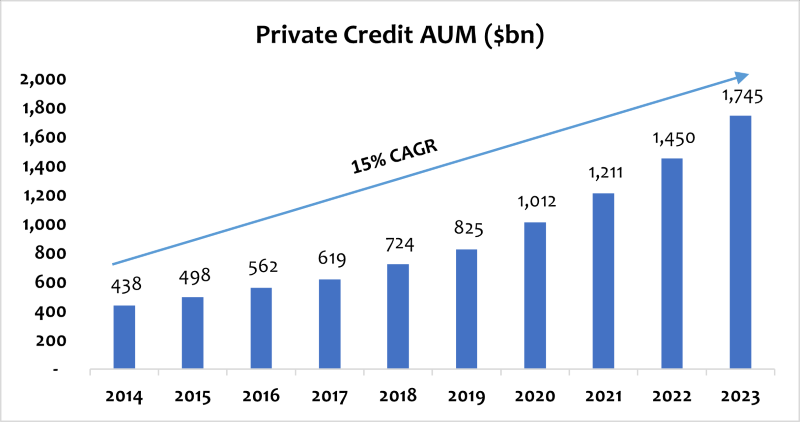

A key factor contributing to the growth of credit secondaries has been the maturation of the private debt market. As illustrated in today’s Chart of the Week, private credit assets under management have grown at a 15% compound annual growth rate (CAGR) over the last decade, surpassing $1.7 trillion as of December 31, 2023. This expansion has been driven by asset managers stepping in to fill the lending gap created by banks' reduced capacity and willingness to lend, a consequence of new regulations introduced in the aftermath of the Global Financial Crisis.

With more private credit funds being launched and significant capital deployed, the need for liquidity solutions has grown. This development has led to a more robust and efficient secondary market, where investors can trade positions in private credit funds and portfolios of individual loans. Improved transparency and valuation methods have also made it easier for buyers and sellers to agree on pricing, further fueling market growth. The annual volume of credit secondary transactions is currently estimated to be as high as $30 billion and market participants expect it could grow to $50 billion by 2027.1

Investors may find credit secondaries appealing for a number of reasons, including the potential for improved risk-adjusted returns and enhanced diversification. One of the most attractive features of the asset class is the ability to potentially acquire assets at a discount to net asset value (NAV), which provides a form of return not available to primary investors. Credit secondaries also offer the ability to diversify private credit exposure across various dimensions, including fund managers, geographies, sub-strategies, industries, security types and vintage. By purchasing existing credit investments, secondary buyers can gain access to seasoned portfolios with known performance histories, reducing the uncertainty associated with primary investments, referred to as “blind-pool risk.” Additionally, credit secondaries often come with shorter durations, allowing investors to achieve liquidity more quickly than with traditional private credit investments.

However, like any other investment, credit secondaries entail specific considerations and risks. Accurate valuation of the underlying credit assets is crucial due to the complexity of private credit investments. Moreover, thorough due diligence is essential to assess the quality of the assets and the creditworthiness of the borrowers, as well as the underwriting quality and risk monitoring practices of the lender. Investors must also be mindful of the potential for adverse selection, where sellers seek to offload less desirable assets, leaving buyers with higher-risk investments. Lastly, market liquidity can vary, and during periods of economic stress, the secondary market for credit may become less liquid, making it challenging to exit positions.

Key Takeaway

The growth of credit secondaries represents a significant development in the financial markets, offering new opportunities for investors seeking exposure to private credit. While the market has matured and offers various benefits, investors must approach it with a careful understanding of the inherent risks and complexities. Thorough due diligence, accurate valuation and an awareness of market conditions are critical to navigating the credit secondaries market successfully. As the market continues to evolve, it is likely to play an increasingly important role in the broader investment landscape, providing valuable liquidity solutions and investment opportunities for a wide range of market participants.

Source:

1Pensions&Investments – Private Credit Boom Helps Secondaries Market Heat Up; 4/12/24

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.