Unemployment Needing Sahm Help

July 25, 2024

U.S. equities are near all-time highs, and credit spreads are near all-time lows as investors eagerly await the Federal Reserve (Fed) interest rate cuts. The unemployment rate is 4.0%,1 which has underpinned the strong economy the U.S. has experienced post-pandemic. Two years ago, the Fed became increasingly focused on defeating its number one enemy — inflation. As a result, in the spring of 2022, Fed Chair Powell began raising interest rates from near 0% to the current level of close to 5.33%.2 Inflation has been eroding workers’ wages and purchasing power. At over 9% in 2022,3 it was already out of control. Inflation has gradually moved lower with higher interest rates in place, yet the economy has remained resilient.

Two years after the first rate hike, some investors believe that inflation has been tamed at 3%,4 while the economy still appears very strong. Corporations are in the middle of earnings season, and throughout 2024, results have been solid. With analysts calling for further growth in earnings coupled with an election in November, there is optimism that more positive catalysts can drive markets higher. The stage is set for a continued Goldilocks scenario — tame inflation, low unemployment and strong economy.

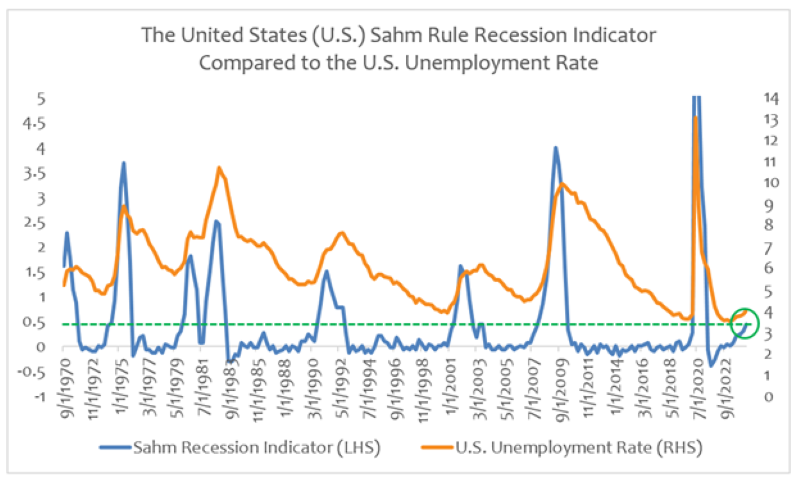

What if we aren’t in a Goldilocks scenario, and how would we know in real time? Fortunately, in 2019 a rule was constructed by Claudia Sahm that perfectly coincides with, and would have seemingly indicated the start of every recession since 1970. The rule “signals the start of a recession when the three-month moving average of the national unemployment rate rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months.”5

As seen in today’s Chart of the Week, the Sahm Recession Indicator is dangerously approaching that 0.50% level (0.43% as of June 2024).6 It is certainly possible that this cycle avoids the unemployment rate rising and breaching that 0.50% threshold in the near term. Perhaps the Fed has played its hand perfectly and rate cuts will thread the needle of curtailing inflation and not spiking unemployment. In the future, maybe there will be exceptions to the rule. Notably, the Sahm Recession Indicator also came with a proposal to help mitigate a recession when that threshold is breached.

Claudia Sahm introduced her namesake indicator as part of a policy proposal called “Direct Stimulus Payments to Individuals,” a project published by the Hamilton Project.7 In her paper, she explained that a proactive approach through stimulus payments could offset approximately half of the slowdown in consumer spending. The stimulus payments would help to mitigate a sharp slowdown in consumer spending, as a decline in spending could result in increased corporate layoffs and a weaker economy.

Key Takeaway:

The Sahm Recession Indicator was introduced in 2019, clearly before the pandemic. Interestingly, when unemployment spiked in 2020 as a result of the pandemic, the government enacted a strategy similar to Sahm’s proposal — stimulus payments. Perhaps the strategy was coincidental, but even if the U.S. was following Sahm’s proposal, we won’t really be able to pinpoint exactly what led to the economic rebound following the pandemic. The U.S. economy experienced a “V” shaped recovery and one of the strongest booming economies in some time. Perhaps there is a playbook for stimulus payments if we breach the recession indicator; however, one that avoids subsequent and sustained inflation.

Could equity and credit markets be onto something? If the Fed can cut rates and the Sahm proposal can help mitigate a deep unemployment crisis, perhaps there are two put options for investors to rely on — stay the course and remain invested.

Sources:

1-4Bloomberg

5,6Federal Reserve Bank of St. Louis – Sahm Recession Indicator; June 2024

7The Brookings Institute – The Hamilton Project: Direct stimulus payments to individuals; 5/16/19

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.