The Ups and Downs of Balanced Portfolios

August 1, 2024

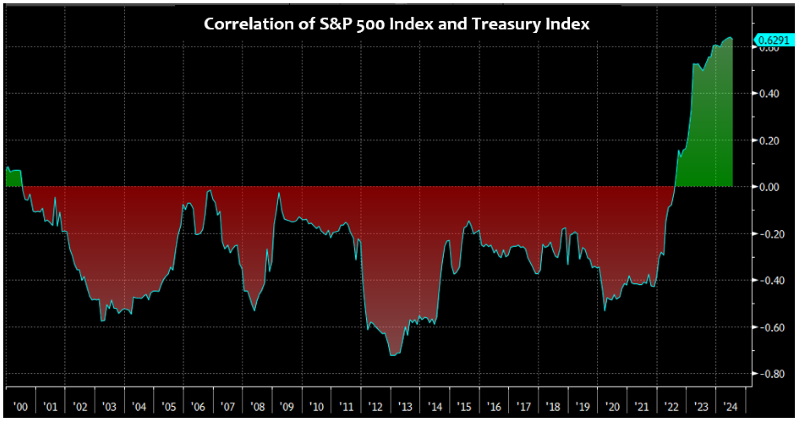

The traditional balanced portfolio has experienced significant fluctuations in recent years, leading many investors to question the appropriate asset allocation. The argument for the balanced portfolio (typically a 60% allocation to equities and 40% to bonds) is that while a return on a mix of equities and bonds may be lower than an equities-only portfolio in times of growth, the hedge of bonds somewhat offsetting equity selloffs will provide downside protection and less return dispersion long term. As long as the correlation between stocks and bonds is negative, the balanced portfolio has been effective.

From the late 1990s, the correlation of stock-bond returns began a steady decline and turned negative in the early 2000s. However, as displayed in today’s Chart of the Week, the post-pandemic period has witnessed a significant spike in correlation. Historically, the negative correlation of these asset classes has been related to the positive correlation of growth and inflation. When growth is strong and equity markets rally, inflation also increases which keeps nominal yields high and hurts fixed-income returns. As growth slows, earnings recession fears grow and equities decline while bonds experience a safe-haven bid as lower inflation expectations increase.

The post-pandemic period resulted in significant central bank policy easing globally along with substantial U.S. fiscal easing. Approximately two years later, with inflation reaching levels not seen since the 1980s,1 dramatically tighter monetary policy commenced and growth was surprisingly resilient. This macro environment led to a spike in fixed-income volatility and the lowest bond returns experienced in decades.2 Likewise, the traditional 60/40 balanced portfolio saw its worst annual return since the Great Depression.3 One aspect that has led to the success of the 60/40 strategy up until the pandemic period has been the long secular bull market for yields since the early 1980s;4 Treasury yields bottomed in 2020 with the 10-year Treasury hitting 0.51%.5

Key Takeaway

As the relationship among economic growth, yields, inflation and policy normalize in the coming years, I anticipate the stock-bond correlation to also normalize off of what appear to be somewhat extreme levels. One wild card could be the long-term impact of artificial intelligence (AI) and the possibility that it lifts growth while reducing inflation. This could again lead to positive stock-bond correlation; though this could perhaps allow both equities and bonds to perform well. With today’s Treasury yields sitting at levels not attained since 2007,6 higher yields and higher long-term expected returns can rationalize bonds as a source of return and not simply a diversifier for balanced portfolios.

Sources:

1-2,4-6Bloomberg

3WSJ – Investors Embrace Bond Funds Before Rates Start to Fall; 7/29/24

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.