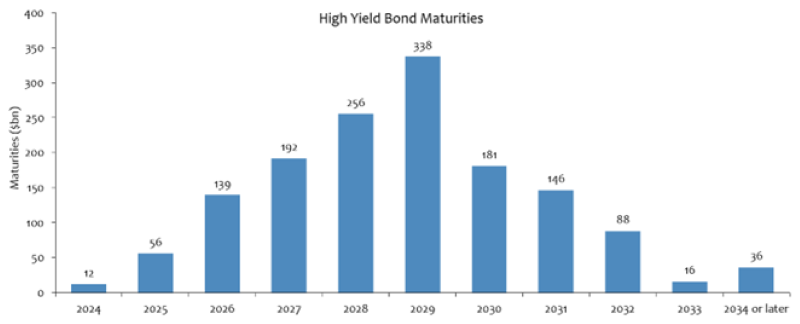

Strong Primary Market Chips Away at the High-Yield Maturity Wall

August 15, 2024

It’s been a good year for risk markets, with inflation moderating and the labor market holding up relatively well. Credit spreads have tightened across corporate and structured asset classes, with some now nearing post-2008 tights.1 The strong performance has been sustained despite a reasonable amount of Treasury rate volatility. The 10-year Treasury yield rose over 60 basis points (bps) during the first four months of the year and essentially retraced that move over the last four months.2 One element that has been consistent throughout the year is the resurgence of the primary market. New issuance, which had been dormant during 2022 and sluggish in 2023, finally came back to life in 2024. High-yield companies have issued approximately $190 million as of August 9, marking an 80% increase.3 The notion that Treasury rates might stay high for longer, the rising cost of floating-rate bank debt, a pickup in mergers and acquisitions (M&A) and attractive spreads are causing issuers to tap the market. Importantly, the primary use of funds in the new-issue market has been to refinance near-term maturities.

The term “maturity wall” refers to the amount of debt coming due in the high yield and leveraged loan market over the next five years. Insolvency and illiquidity are the two primary drivers of default rates, with maturing debt being a component of the latter. Most high-yield bonds are not matured with cash on hand. These bonds are refinanced, and when the primary market isn’t open for an extended period, it can contribute to higher defaults (including distressed exchanges). Market participants consider this an important data point in accessing their near- and medium-term outlook.

Takeaway

The strong primary market in 2024 has done quite a bit to reduce near-term maturities, as seen in today’s Chart of the Week. 2024-2025 maturities are now de minimus and 2026-2027 maturities appear very manageable. Maturities in 2028-2029 are the next hurdle; however, outside of high-coupon debt that is callable, it’s a little early for companies to address.

Sources:

1Bloomberg

2CNBC – U.S. 10-Year Treasury; as of 8/13/24

3J.P. Morgan – Credit Research; 8/9/24

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.