Are We There Yet?

September 5, 2024

The commercial real estate market has faced several challenges over the past few years. Economic uncertainty, declining valuations, rising vacancies and moderating net operating income, along with rising interest rates have put downward pressure on valuations. The pandemic impact certainly had an effect on commercial real estate properties to varying degrees. As the Federal Reserve (Fed) began raising interest rates in 2022 to combat inflation, borrowing costs increased which in turn reduced demand and put downward pressure on prices. The rise in lending costs has challenged some borrowers, particularly those who face near-term loan maturities.

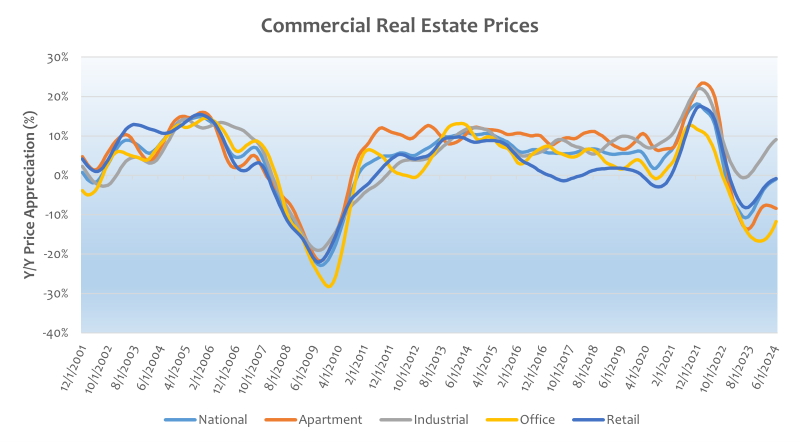

Today’s Chart of the Week highlights the year-over-year price change for the major commercial real estate property types. Prices across sectors have been under pressure since July 2022, falling 11.7%. In the past year, the national price index declined 1%, apartments declined 8.4% and office declined 11.8%. Office properties have faced the greatest challenges in recent years as the demand for office space has been uncertain due to hybrid work models. The industrial sector remains strong and rose 9.1% this past year, with increasing prices reflecting ongoing demand for warehouse and distribution space driven by e-commerce and supply chain needs.

Fed interest rate cuts this year could reduce economic uncertainty, resulting in better price discovery for commercial real estate properties. A lower federal funds rate should help to lower real estate debt costs and alleviate upward pressure on capitalization rates. A decrease in interest rates would further support price stabilization across all property types.

Commercial real estate cycles can be lengthy; however, over the long term, this asset class has historically provided stable income-producing properties that earn a competitive yield. Investors are drawn to the stable cash flow, appreciation benefits and tax advantages of commercial real estate relative to other asset classes. Historically, commercial real estate investments can protect investor portfolios from volatility in the equity markets.

Key Takeaway

Although headwinds remain, commercial real estate property values may be turning a corner. Underlying fundamentals are relatively strong with the exception of office, and most property types are performing well where demand and supply drivers are balanced. I am cautiously optimistic that property prices are nearing a bottom and recovery is on the horizon, but I do not expect price recovery to be a straight line as certain property types and markets will fare better than others. Having a high-quality diversified portfolio across property types and geographies may help to mitigate possible underperformance.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.