Uninverted

September 12, 2024

In the 1980’s classic movie Top Gun, Pete Mitchell, better known by his call-sign Maverick (played by Tom Cruise), bragged about a highly difficult and dangerous maneuver when he flew inverted over an enemy plane. In the world of finance, the term inverted (or inversion) is one that can be quite important as well.

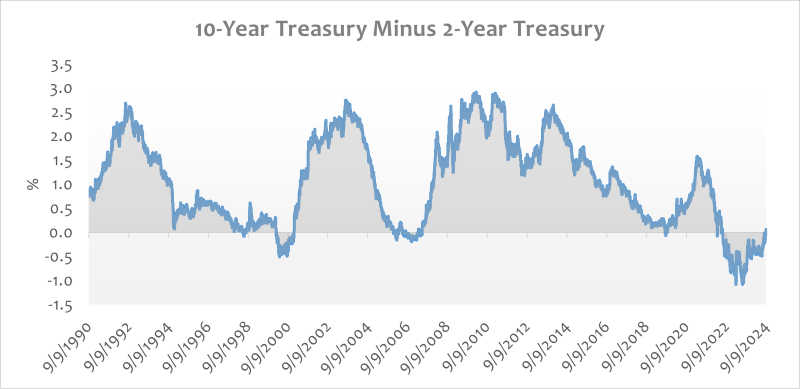

“The longest yield curve inversion in history has ended this past week with the 10-year Treasury yield (3.77%) now one basis point above the 2-year yield (3.76%).” – Charlie Bilello1

The yield curve, the recording of U.S. Treasury bond yields over maturities (short to long, or more specifically, the 2-year yield versus the 10-year yield), is one that is closely watched and analyzed by economists and investors. A normal yield curve, sloping upwards, is an indication that the bond market is acting appropriately and the economy is functioning well. An investor should be able to be compensated with a higher yield the longer their money is invested in the benchmark Treasury bond. However, times are not always normal. At times, the yield curve will shift and become “inverted,” meaning the yield on short-term bonds becomes higher than the yield on longer-term bonds. This inversion tends to be viewed as a potentially negative sign for the economy. If investors are willing to take a lower rate for a longer period of time, this indicates they are concerned about the longer-term health of the economy. An inverted yield curve can also indicate the potential for rising odds of a recession.

Interestingly, when looking at the occurrences of recession over a very long period of time, an inverted yield curve is not nearly as indicative of a pending recession as the un-inversion or eventual yield curve steepening.2 This is the sign, in my opinion, that should cause some consternation. Un-inversions, especially after longer periods of yield curve inversions, have quite often portended recessions.3 A few of the longest inversions — although I dislike stating the specific years because of their connotation — were 1929, 1978 and 2008.4

Every era and every economy has a unique set of circumstances; however, I do believe this is an observation and chart worth noting. For example, the actions of the Federal Reserve (Fed) play a large role on the front end of the yield curve while the market controls the intermediate- and longer-term maturities. Another factor is the relationship between the unemployment rate and the shape of the yield curve — especially as the bond market weakens — which could also be a signal for future economic weakness. The combination of Fed easing and job market softening are a few significant factors which will determine both the yield curve and economic activity.

Key Takeaway

Yield curve inversions have been followed very closely by market participants as the implication is important for the economy and investors alike. The U.S. Treasury yield curve recently went through one of the longest inversions in history due to a combination of the Fed keeping interest rates high and the market demand for intermediate- and longer-term bonds remaining strong. As seen in today’s Chart of the Week, this inversion ended very recently and while it did not lead to a recession (yet), the un-inversion should be viewed within its historical context — as a sign that weakness could lie ahead.

As an investor in income securities, the movement of the Treasury yield curve is one that is watched closely. While we do not know what will come next for the economy or the markets, we seek signs that might give us some information to help guide our decisions. I do not think it is very important that we pick a specific outcome for the economy or the markets – but I do think it is very important that we are aware of and place the proper odds on potential scenarios and outcomes that can impact our portfolios and performance. Per several indicators, the odds of a recession are increasing — yield curve moves, employment data, etc. This is noted. The U.S. experienced an extended period of growth, and it is crucial to be prepared for any potential volatility ahead. Just like a pilot needs to be prepared for turbulence — the worst case scenario might not eventually materialize. However, being aware and preparing for a little bumpiness during the ride ahead may not be a bad idea.

Sources:

Image: Reno Airshow Airplanes Air Show; Pixabay

1X (formerly known as Twitter) – Charlie Bilello; 9/4/24

2,3Bloomberg – The Yield Curve Is Disinverting. Why Should I Care?; 9/5/24

4Reuters – US Treasury key yield curve inversion becomes the longest on record; 3/21/24

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.