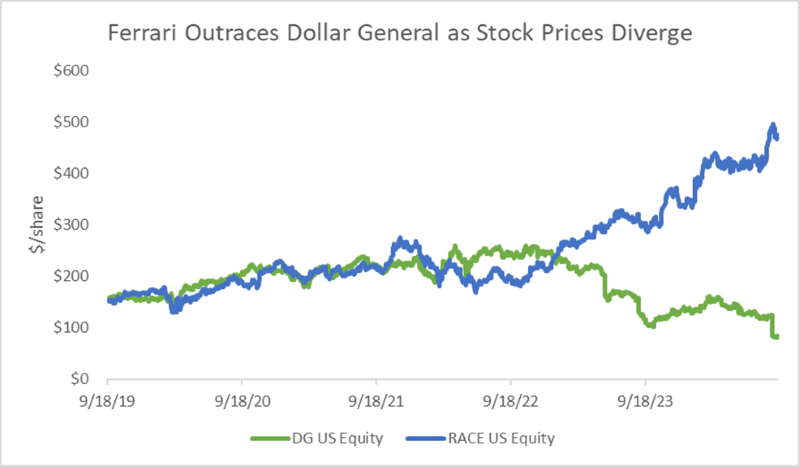

Ferrari Outraces Dollar General as Stock Prices Diverge

September 19, 2024

There is a great deal of excitement surrounding the Ferrari brand after its victory at the 24 Hours of Le Mans for the second consecutive year and Lewis Hamilton poised to join their F1 team after a 12-year stint with Mercedes.1,2 Meanwhile, Ferrari investors have simultaneously benefited as the stock has appreciated substantially since 2019, up 202% over the past five years.3

The company has executed extremely well over the past half-decade as Ferrari has grown revenue by approximately $2.6 billion since 2019 while expanding operating margins 300 basis points (bps) and net margins 250 bps over the same time period.4 This has all been accomplished with moderate leverage (LTM net debt/EBITDA of 0.86x),5 allowing the company to return cash to shareholders via free cash flow. Ferrari has simultaneously invested in the business, particularly with regard to automotive innovation and the construction of its mega e-factory focused on electric vehicle production. Since the start of the company’s multi-year share buyback program instituted in July of 2022, the company has purchased a total of 3.6 million shares for roughly €1.0 billion euros, insinuating that management continues to feel that shares are undervalued.6

Furthermore, Ferrari stock continues to perform well even though it has become much more expensive than it was five years ago. Today, the stock trades at a next twelve months (NTM) price/earnings multiple of 49.5x and NTM enterprise value/EBITDA multiple of 28.8x.7 Expectations are clearly high and investors expect the stock to continue to perform well. This could be warranted as Ferrari stated on its latest earnings call that the reception to its latest new sports cars, the 12Cilindri and 12Cilindri Spider, drove the order collection during the quarter — adding to an order book on current models that is sold out well into 2026.8

One can assume given Ferrari’s financial performance that the higher-income consumer continues to fare relatively well, continuing to spend on goods that are not essential in nature. However, when taking a closer look at the lower-income consumer and where those individuals tend to shop, the results are much different and companies that serve this segment of customer have suffered, Dollar General for example.

Taking a glance at Dollar General’s stock performance over the same time frame as Ferrari, the company has not performed well. Dollar General stock is down approximately 45% since 2019,9 and commentary around Dollar General is that the company isn’t living up to its name as prices continue to rise. Inflation has impacted the majority of these customers more than, for instance, a car enthusiast looking to purchase a new Ferrari.

Dollar General generated $10.2 billion in sales in the second quarter of 2024, a 4.2% increase over the same period last year.10 However, same-store sales only grew 0.5% in the quarter, which was below management’s expectations.11 In the most recent earnings call transcript, Dollar General CEO Todd Vasos provided some color on what they are hearing from customers. Many lower-income consumers feel worse off financially than they did six months ago as higher interest rates and a softer employment environment have had a negative impact on consumer wallets. As the Federal Reserve (Fed) has battled to fight inflation, over 60% of Dollar General customers cited that higher inflation has caused them to sacrifice on purchasing basic necessities due to overall costs while struggling to pay rent, utilities and healthcare.12

As a result of these different scenarios, Dollar General updated its fiscal year guidance to incorporate feedback from customers as well as the economic environment in general. Management guided sales for the year to grow roughly 4.7% to 5.3% with same-store sales growth in the range of 1.0% to 1.6%.13 In addition to lowering sales guidance, Vasos mentioned that increased promotional activity would negatively impact margins, assuming no improvement in the back half of the year. Not surprisingly, the stock sold off materially after the call. The Fed lowered rates by 50 bps on Wednesday which should benefit lower-income consumers who may be struggling with financial hardship.

Overall, there is a wide divergence between the higher-income and lower-income consumer which is evident when analyzing the recent Ferrari and Dollar General results. In addition, when listening to other dollar store earnings calls, there has been similar commentary and depressed stock performance compared to luxury stocks.

Key Takeaway:

Ferrari and Dollar General stock prices have diverged materially as the higher-income consumer is still willing to spend on luxury goods while the lower-income consumer faces a more dire reality. Higher-income consumers continue to be less impacted by elevated interest rates and their personal balance sheets remain healthy. Finally, lower-income consumers continue to seek value while cutting back on unnecessary spending. It will be interesting to continue to watch the divergence between these two stocks for the remainder of the year and into 2025 as the economy starts to improve and interest rates begin to come down.

Sources:

1Ferrari – Ferrari Wins 24 Hours of Le Mans 2024, Repeating Last Year’s Triumph; 6/16/2024

2Forbes – Why Lewis Hamilton Joining Ferrari Is Good News For Charles Leclerc; 8/21/2024

3Ferrari Stock Performance; as of 9/18/2024

4,5,7TIKR; as of 9/18/24

6Ferrari – Ferrari N.V.: Periodic Report on the Buyback Program; 9/16/2024

8Bloomberg – Ferrari Q2 2024 Earnings Call Transcript; 8/1/2024

9Dollar General Stock Performance; as of 9/18/2019

10-13Bloomberg – Dollar General Q2 2024 Earnings Call Transcript; 8/29/2024

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.