Fed's Rate Cut Boosts Markets, but Uncertainty Remains

September 26, 2024

On September 18, the Federal Reserve (Fed) made a pivotal decision to reduce interest rates by half a percentage point, lowering them to a range of 4.75% to 5%. This move represents a notable policy shift, as the central bank refocuses from its previous emphasis on curbing inflation to addressing a softening labor market. With inflation showing signs of easing, the Fed is now prioritizing economic stability, aiming to mitigate job losses and stimulate growth. The rate cut, made proactively, is intended to shield the economy from a potential downturn and guide it toward a smoother recovery.

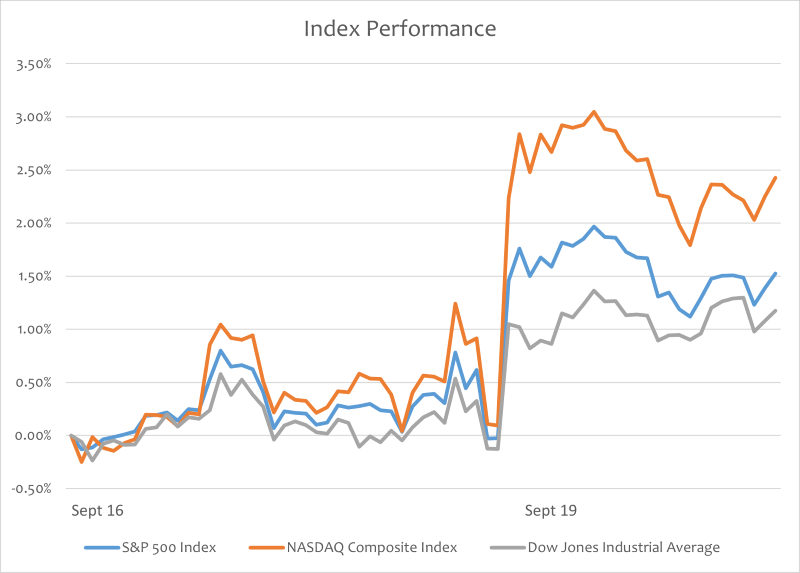

Today’s Chart of the Week illustrates the market's strong reaction, with a sharp rebound following initial hesitation. The NASDAQ Composite Index climbed 3.0%, while the S&P 500 Index rose 1.9%, both reaching new yearly highs. The Dow Jones Industrial Average also surged past the 42,000-point mark.1 Investors are optimistic that lower borrowing costs will boost corporate profits and consumer spending, helping to keep the economy on solid ground. Gold futures settled at a record of $2,621 per ounce,2 reflecting its role as a safe-haven asset amid broader market optimism, while Bitcoin climbed 5.3%,3 benefiting from increased risk appetite following the Fed's aggressive rate cut.

However, despite the market’s positive response, risks remain. While the immediate reduction in borrowing costs is beneficial, businesses and households with fixed-rate debts may face higher refinancing costs as older loans mature. Additionally, although the Fed aims to sustain growth, inflation could reemerge if demand outpaces supply. Furthermore, much of the benefit from lower rates may have already been priced into the market, limiting further stock gains if upcoming economic data falls short of expectations.

The Fed’s future actions will largely depend on economic indicators, particularly from the labor market. The central bank faces the challenge of supporting growth while avoiding the risk of reigniting inflation. While the rate cut has bolstered market optimism for now, uncertainty about the broader economic outlook persists, and all eyes are on how conditions evolve in the coming months.

Key Takeaway:

The Fed’s recent rate cut marks a shift in its policy focus, moving from inflation control to supporting a cooling labor market and fostering economic stability. While the markets have responded positively, with gains across major indices and increased confidence in riskier assets, there are lingering risks, such as potential refinancing challenges and the possibility of inflation rebounding. The Fed must carefully balance promoting growth without triggering inflation, as the future of the economy depends on evolving economic signals, particularly from the labor market.

Sources:

1-3Bloomberg

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.