A Potentially Historic Strike

October 3, 2024

The pandemic revealed just how fragile supply chains can be. I can recount dozens of companies that cited supply chain issues on earnings calls that resulted in underperformance and created shortages of many goods. The latest potential supply chain issue came earlier this week on October 1 as the International Longshoremen's Association (ILA), including over 45,000 dockworkers at 36 ports from Maine to Texas, went on strike.1 Dockworkers are seeking a sizable wage increase as well as protections against automated technology. Automation is an existential threat to the ILA.

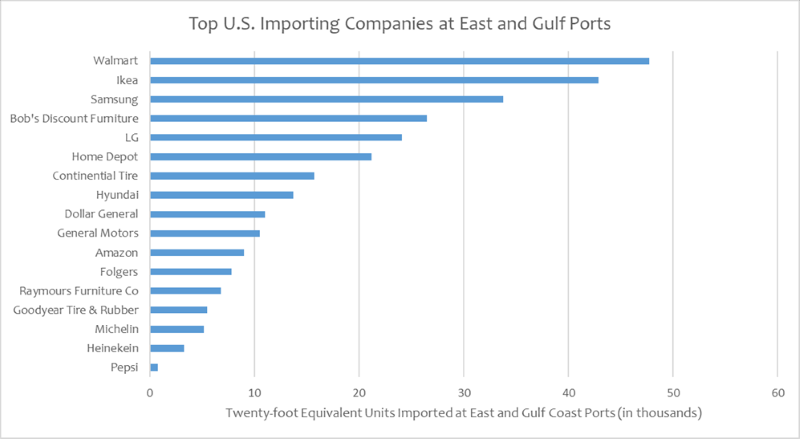

The last strike by ILA dockworkers along the U.S. East and Gulf Coast ports occurred in 1977,2 marking this the largest shutdown of U.S. ports in nearly 50 years. This is certainly historic, and could be problematic as more than 40% of total containerized goods enter the U.S. through ports on the East Coast and Gulf Coast.3 Today’s Chart of the Week highlights companies most dependent on these ports that could potentially be the greatest impacted by the strike.

Predictions for the strike outcome vary widely as some analysts suggest the strike could last a few weeks while others foresee potential disruptions extending into late October or early November. The more positive outcomes cited that port strikes typically do not last more than a few days or weeks as President Biden can invoke the Taft-Hartley Act, which gives the president the authority to reopen the ports and impose an 80-day cooling-off period, during which dockworkers are required to work.4 Analysts have also emphasized the length of U.S. West Coast strikes, noting a 10-day lockout in 2002, a 7-day strike in 2012 and six lost days in 2014-15.5

With the busy fall shopping season underway, big retailers expect to withstand the strike (for now) as products were brought in earlier than usual while other cargoes were diverted to West Coast ports in the event a strike occurred. Nevertheless, executives have stated a strike lasting a week or longer would increase shipping costs and potentially trigger product shortages.6

“Shoppers can rest assured holiday merchandise will be on shelves,” said Brian Dodge, president of the Retail Industry Leaders Association, which represents stores such as Best Buy, Home Depot, Gap and Dollar General.7 However, Dodge also stated, “The longer this work stoppage goes on, the harder it will become to shield customers from its effects.”8

There is certainly a possibility of this more negative outcome if the strike persists. The two sides are not aligned on wages and automation. Harold Daggett, international president and chief negotiator of the ILA, communicated to hundreds of dockworkers that “This is going down in history what we’re doing here.”9 In addition, Daggett stressed, “Nothing’s going to move without us.”10 The ILA has expressed readiness to continue striking until a satisfactory contract is secured. Daggett previously warned a strike had the power to “cripple” the U.S. economy, by blocking the import of everything from cars and clothes to construction materials.11 With Daggett’s remarks in mind, the strike could be very impactful and unpleasant for businesses and consumers.

Key Takeaway:

A massive dockworker strike at ports on the U.S. East and Gulf Coasts has potential to wreak havoc on global supply chains. American consumers would likely notice shortages of popular products amid a prolonged strike. The stability of supply chains is more critical than ever to maintain economic growth and ensure that businesses can meet consumer demand. This strike adds more uncertainty to markets, and hopefully the two sides can come to an agreement or a resolution is made soon.

Sources:

1,2Reuters – US dockworkers strike, halting half the nation's ocean shipping; 10/1/24

3Xeneta – Port strikes on US East Coast will cause major supply chain disruption into 2025, with Government intervention needed to prevent damage to economy; 9/30/24

4,5Bank of America Global Research; October 2024

6-10The Wall Street Journal – Dockworkers Launch Strike at Ports From Maine to Texas; 10/1/24

11Morningstar – 'I will cripple you' - dockworker's union vows to shut down U.S. economy with strike; 10/1/24

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.