So long, Cash?

October 17, 2024

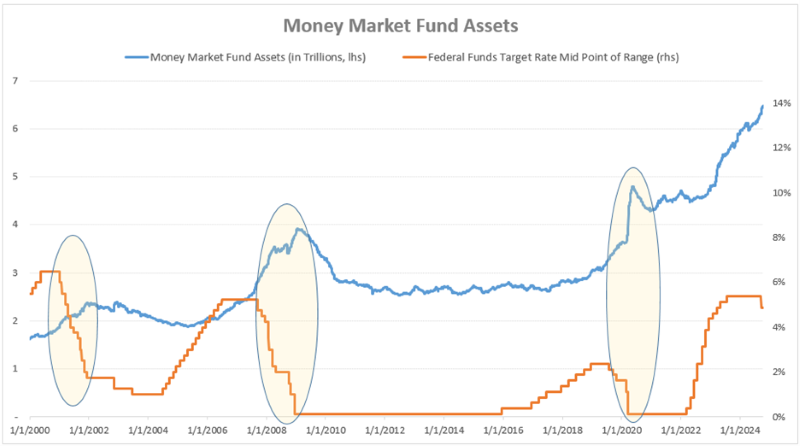

Money market funds, which invest in short-term, high-quality debt securities such as Treasury bills, repurchase contracts and commercial paper, have seen substantial inflows since the COVID-19 pandemic. As of October 9, 2024, total U.S. money market fund assets reached a record $6.5 trillion.1

The yields on these funds are largely tied to the federal funds rate, set by the Federal Open Market Committee (FOMC). With the Federal Reserve (Fed) raising rates since March of 2022 in order to combat inflation, the federal funds rate peaked in July of 2023.2 This has allowed money market funds to offer yields over 5% with minimal risk3 — an attractive proposition for many investors. However, since the Fed cut rates by 50 basis points and guided further rate cuts at its September meeting, questions have emerged regarding the future of money market fund investments. Will investors begin to pull capital from money market funds? History may offer some clues.

Since 2000, the Fed has initiated four rate-cutting cycles — 2001–2002, 2007–2008, 2019 and 2020.4 Interestingly, during each of these periods, money market fund assets continued to grow, suggesting yield may not be the only factor considered in investor decisions. Typically, the Fed cuts rates during economic downturns, and in all but one of the past cycles (2019), these rate cuts were followed by recessions.5 Even in the case of 2019, the cut was induced by uncertainties and fears of a slowdown. In these scenarios, safety and liquidity weigh heavily on investor decisions. However, today’s economic outlook appears brighter compared to those previous occurrences.

According to the Fed household balance sheet data, the share of money market funds in household financial assets has grown from 2.4% at the end of 2019 to 3.4% in the second quarter of 2024,6 suggesting bandwidth for reallocation away from money market funds. However, since 2000, there have been only two distinct periods of noticeable outflows from money market funds, both catalyzed by the federal funds rate reaching 1% or lower. Currently, the Fed projects rates to bottom out around 3% by 2026.7 Even at that point, a 3% yield remains an acceptable investment option compared to previous cycles where rates fell much further.

If a reallocation from money market funds does occur, fixed-income assets — such as Treasury securities and corporate bonds — are likely to benefit first. Shifts in asset allocation tend to be gradual; therefore, a move into riskier assets, including equities, seems less probable. Yet, with money market funds still offering the highest yields along the Treasury yield curve,8 and investment-grade corporate credit averaging around 5%,9 the yield premium for taking on extra duration or credit risk is not convincing. In my opinion, an immediate shift into other asset classes is unlikely in the near term.

Key Takeaway:

Money market funds have attracted trillions in capital in recent years, and their appeal is clear. While money market yields are set to decline as the Fed continues to cut rates, investors will consider risk, return, liquidity and relative value, among other factors, when making allocation decisions. For the near future, the case for significant outflows from money market funds remains weak.

Sources:

1,3, 6-9Bloomberg

2U.S. Bank – Federal Reserve recalibrates monetary policy as inflation recedes; 9/20/24

4Forbes – Federal Funds Rate History 1990 to 2024; 9/18/24

5Federal Reserve Bank of St Louis – Dates of U.S. recessions as inferred by GDP-based recession indicator; as of 10/17/24

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.