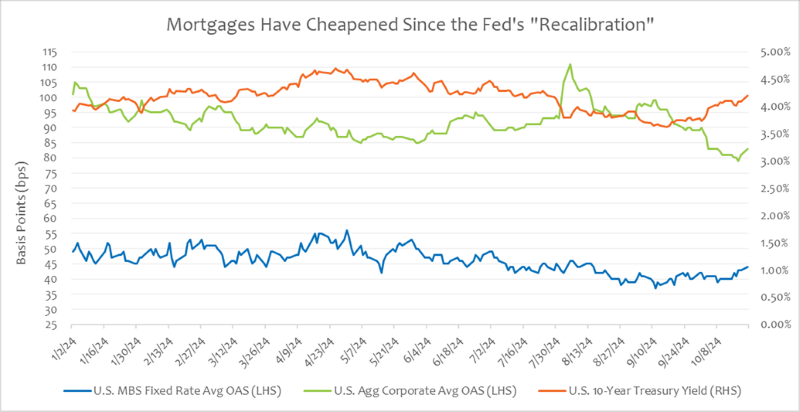

Mortgages Have Cheapened Since the Fed's "Recalibration"

October 24, 2024

On September 18, the Federal Reserve (Fed) lowered interest rates for the first time since March 2020,1 choosing to cut its policy rate by 50 basis points (bps) in what Fed Chair Powell characterized as a “recalibration of our policy stance.”2 Prior to the Fed’s decision, markets had been split on whether the cut would be 25 or 50 bps. Mortgage-backed securities (MBS) reacted favorably to the larger rate cut initially, with MBS spreads tightening on the belief that Fed policy was now favoring lower and less volatile interest rates.3

Today’s Chart of the Week shows the option-adjusted spreads (OAS) for MBS and investment-grade corporate bonds alongside the 10-year Treasury yield. Since the Fed’s 50-basis-point cut on September 18, Treasury yields have risen, MBS spreads have cheapened and corporate credit spreads have richened. Stronger-than-expected economic data over the past month has pushed Treasury yields higher as market participants price in a slower pace of Fed easing and inflation concerns reemerge. The rise in yields and resilience of the U.S. economy have driven demand for corporate credit with the OAS on the corporate credit index last week hitting its lowest level post-Global Financial Crisis.4 The MBS index — which consists of residential mortgages backed by the U.S. government — has widened in OAS over the same period as the rise in Treasury yields have driven interest rate volatility higher.5

Key Takeaway

The rise in interest rates over the past month has caused MBS valuations to cheapen and look attractive relative to Treasuries and U.S. corporate bonds. However, the continued resilience of the U.S. economy and possibility of additional fiscal stimulus coming out of the U.S. election could continue this trend in interest rates and prevent MBS valuations from improving.

Sources:

1CNBC – The Federal Reserve just cut interest rates by 50 basis points—here’s what will get cheaper; 9/18/24

2Federal Reserve Board – Transcript of Chair Powell’s Press Conference September 18, 2024

3-5Bloomberg

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.