Zombie Funds Haunt the VC Landscape This Halloween

October 31, 2024

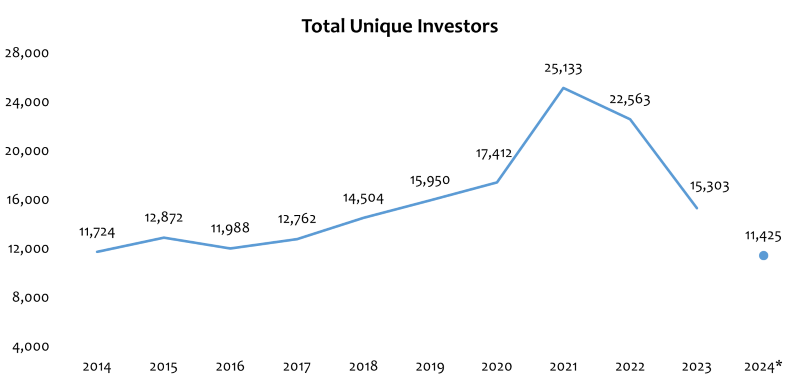

In March, I highlighted the challenging fundraising environment for venture capital (VC) funds, which had reached a six-year low. This week’s chart sheds light on the downstream effects of that slowdown, and its impact on the broader venture ecosystem. As illustrated in today’s Chart of the Week, the number of unique investors participating in financing rounds of U.S. start-ups has sharply declined, dropping from a peak of over 25,000 in 2021 to fewer than 12,000 today.1

A "zombie fund" is a fund that no longer actively invests in new companies or supports existing portfolio companies through follow-on investments. Despite this inactivity, the fund continues to operate, primarily collecting management fees while holding onto assets with limited prospects for significant value realization. These funds typically struggle to exit their investments or raise additional capital, yet remain in existence, managing a stagnant portfolio with limited upside.

Zombie funds often arise from a combination of poor performance and market-specific conditions, and are most prevalent following a market collapse. In such cases, the fund may have been overly optimistic about the potential of its portfolio companies. As these companies struggle to achieve key growth milestones or face declining valuations, the fund’s ability to secure exits and return capital to investors diminishes. Over time, an aging portfolio and a lackluster track record make it increasingly difficult to raise fresh capital for follow-on investments or launch new funds.

A notable example occurred during the late 1990s, when VC funds invested heavily in internet-based companies with little regard for long-term viability, driven by hype and speculation. As valuations soared, it appeared that nearly every internet startup was on a path to initial public offering (IPO) or acquisition. However, when the dot-com bubble burst in 2000, many venture-backed companies failed to meet their lofty growth expectations, leading to widespread closures or distressed sales. Venture funds with significant exposure to these internet startups suffered severe portfolio losses, with many becoming zombie funds as they were left with few viable exit options.

For limited partners (LPs), zombie funds present a significant challenge. When a VC fund drags on without delivering returns, LPs face illiquidity — their capital remains tied up for years, sometimes far beyond the fund's stated lifespan. In these cases, LPs not only miss out on expected returns, but their ability to reinvest that capital into more promising investments is also hindered. The prolonged lifespan of zombie funds forces LPs into a passive role, watching as management fees erode the potential for profit. Moreover, being associated with an underperforming or stagnant fund can have implications for future capital commitments and relationships with other VC managers.

Lastly, zombie funds can contribute to the proliferation of "walking dead" startups — companies that are no longer growing or scaling but are kept alive through limited resources, unable to generate meaningful exits. Startups backed by zombie funds often face challenges in raising new funds, which can lead to down rounds, diluting their value and forcing them to scale back operations. The lack of engagement from fund managers also hampers startups’ ability to attract top talent and secure exits, while the presence of a zombie fund on their cap table can deter potential investors.

Key Takeaway

Much like the venture market leading up to the dot-com crash, the boom in 2020-2021 was driven by ideal market conditions, an influx of capital and the entry of many new VC investors, resulting in speculative behavior and soaring valuations. As the market has cooled, we've witnessed valuation resets and a significant slowdown in liquidity events. Consequently, many funds are now languishing, which presents a serious challenge for LPs facing illiquidity and diminished returns. However, proactive measures — such as secondary market exits, fund wind-downs and stronger governance — can help mitigate these issues. For investors, identifying the early signs of a potential zombie fund and being strategic in fund selection are critical to avoiding prolonged capital lockup and underperformance. As the venture ecosystem continues to evolve, it is important to remain disciplined and cognizant of market conditions.

Happy Halloween!

Source:

1Q3 2024 PitchBook-NVCA Venture Monitor Report

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.