Fixed Income Investing: Why Staying Active Makes Sense

November 7, 2024

Given the events of this week, I would be remiss not to mention the U.S. presidential election and its impact on markets. The markets have been gearing up and voting each day in anticipation of the outcome.

Even with general election uncertainty witnessed, most markets were moving full steam ahead posting very strong results year-to-date (YTD). The S&P 500 Index is up over 20% through October.1 Almost all fixed income key indices are posting positive returns as well.2 One of the few negative returns on the year has come from U.S. Treasuries at -1.41%.3 The recent spike in Treasury rates has pressured fixed-income returns during the month of October. On the credit side, U.S. corporate high yield is up by 7.42% YTD,4 lead by the lowest-rated cohort of CCC bonds up more than 13%.5 The highest rated high yield cohort of BB bonds is up a respectable 5.84% but trailed the index as a whole and underperformed the lower-quality issuers.6 For context, U.S. investment-grade corporate bonds are up 2.77%.7

I often highlight the index levels and returns of various benchmarks for several reasons. First, they are great barometers for investor sentiment on risk and the economy. Second, they are the end result of all the votes cast each day in real-time, culminating any historical time period. Investors have the opportunity to vote each day markets are open, continuing to support existing investments or make new investments. Third, most active managers are measured against these benchmarks.

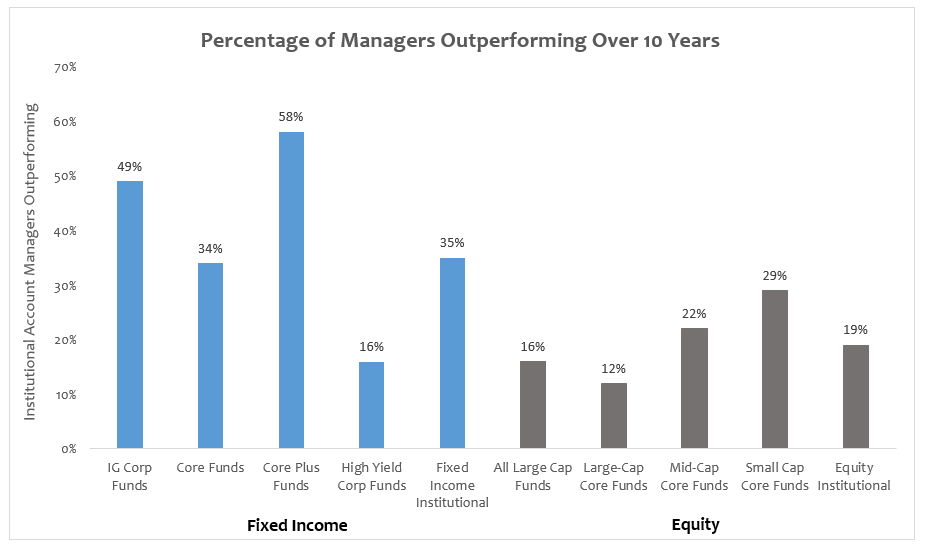

Today’s Chart of the Week highlights long-term performance of institutional active managers versus their benchmarks. Torsten Slok, Apollo’s chief economist, recently highlighted how the experts have performed versus those benchmarks over the short and long term. Fixed-income managers have generally proven to be more successful at outperforming their benchmarks compared to equity managers,8 and both perform better in the short term.9 Top managers are hard to find, but as seen in today’s chart, you have better odds of finding that manager in fixed income.

Key Takeaway

When evaluating investments in active management, investors should consider that historically fixed-income managers have typically been more successful at outperforming their benchmark than their equity counterparts. Through a prudent, strategic and disciplined investment decision-making process, we’ll continue to build on our strong long-term track records. As always, stay the course, stay informed and stay invested.

Sources:

1-7Bloomberg

8,9S&P Dow Jones Indices – SPIVA® U.S. Focus Mid-Year 2024 Highlights

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.