How Low Can We Go?

November 14, 2024

Risk markets have rallied strongly in the past week on the heels of the election. Aside from anticipated policy changes, the decisive nature of the outcome and avoidance of a prolonged and contested decision may have supported the rally. Banks and energy provided the most positive reaction in credit and equities while utilities have been underperforming.1 Investment-grade (IG) corporate credit spreads tightened meaningfully late last week and set year-to-date tight spread levels at a 74 option-adjusted spread (OAS).2 In fact, spreads are at levels not witnessed since the 1990s.3

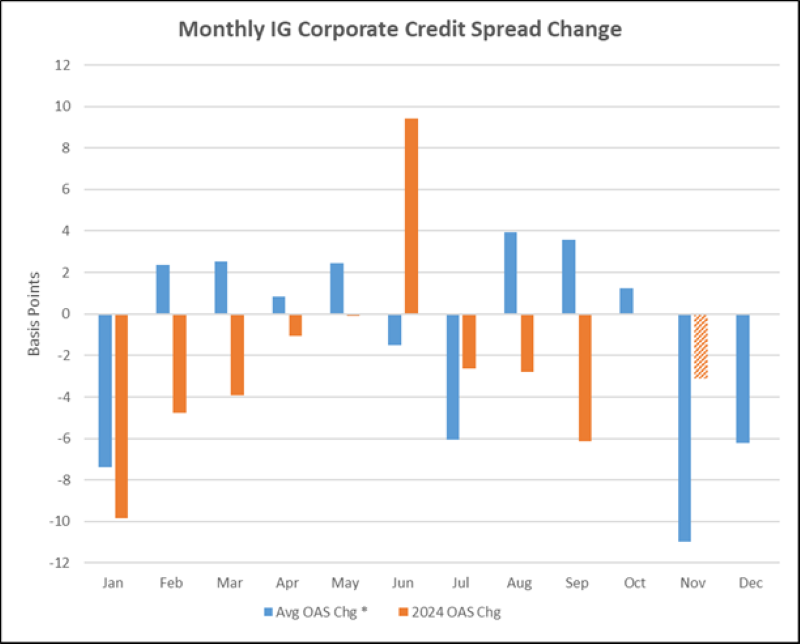

Following this market reaction, the question becomes — how low can we go in spreads? As we head into the close of 2024, there are several items to consider. First, there has historically been a slight seasonal effect at this time of year. Today’s Chart of the Week highlights the average IG corporate spread change by month. It is important to note that November and December, on average, have shown strong performance with supply that is typically light. Additionally, some of this year’s supply may have been pulled forward ahead of the election, leading to possibly even less issuance into year-end and a stronger technical.

The last time spreads widened in December was in 2018, during the Federal Reserve (Fed) rate-hiking cycle.4 With the Fed clearly in an easing mode (though the pace could slow), this would also support the argument for firmer spreads. The higher-rate backdrop will likely keep spreads firm with all-in yield buyers stepping in on any back-up.

Demand for corporate credit remains robust.5 Cash inflows have been steadily strong for the year, with no change to the pre-and post-election pace. Likewise, the overseas bid for U.S. corporate bonds has only grown as hedging costs have declined. Further Fed rate cuts will continue to reduce these costs.

Key Takeaway

Current spread levels may give investors pause to expect further improvement in corporate credit. With earnings season nearly complete, corporate fundamentals are in good shape and there are strong points to be made for spreads to continue to grind tighter. For the remainder of 2024 and into early 2025, absent a major geopolitical event, the path of least resistance for spreads seems to be tighter.

Sources:

1,2,4Bloomberg

3Reuters – Relentless U.S. Credit Demand Seen Driving Second Quarter Rally; 4/1/24

5J.P.Morgan, EPFR

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.