What’s Driving Yields?

November 21, 2024

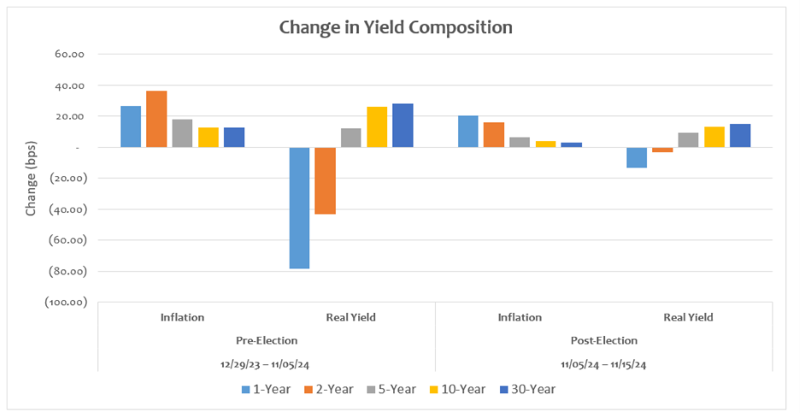

In 2024, we have seen quite a bear steepening in the yield curve, with all but tenors 1 year or less rising in yield. As we have recently experienced the biggest event of the year, the U.S. presidential election, it feels like the right time to assess what has been driving all the action. In today’s Chart of the Week, I will examine the change in the components that make up yields both pre- and post-election.

In theory, the yields on Treasury bonds should reflect three things — the amount of inflation an investor needs to be compensated for, the path of short-term Federal Reserve (Fed) interest rate policy and future economic growth. The second and third components comprise the real yield of the bond, the compensation offered above the rate of inflation. Naturally, different tenors will weight how important economic growth is versus Fed policy differently. Typically, the shorter the bond, the more important Fed policy is in determining the yield. Conversely, the longer the bond, the more important future economic growth will be. In today’s chart, one can assume the real yield on the 1-year bond is being determined by anticipated Fed actions while the real yield on the 30-year bond is being determined by expected economic growth. The tenors in between represent a mix of the two. It can also be argued that longer-term bonds require a term premium to account for uncertainty around the future fiscal health of the issuing government.

Beginning with the pre-election bond market, the path of inflation was priced higher across tenors. Coming into 2024, market inflation expectations were on an extremely low base. The end of 2023 saw several encouraging data points that led investors to price in an optimistic path for future inflation. As 2024 has unfolded, consumer price index (CPI) data has proven to be stickier than these lofty expectations and the market has repriced future inflation expectations higher. On the real yield side, we witnessed a divergence between short-term tenors and the rest of the curve. The 1-year and 2-year real yield has been influenced greatly by the start of the Fed cutting cycle. Through November, the Fed Funds rate has been reduced by 75 basis points this year and the Fed has signaled that as long as labor and growth data hold up, this cutting cycle will continue. Longer-dated real yields have moved upwards as economic growth and labor market data have been extremely resilient.

Examining the post-election period, there are some key similarities and differences. While the underlying drivers are following similar patterns, the narrative surrounding the moves is much different. With the resulting red sweep, the bond market has been grappling with the implications of future policy priorities. The impact of higher tariffs can be seen most notably in the inflation components. While inflation expectations have traded higher across the curve since the election, the largest impact is in short-dated 1-year and 2-year expectations. This is reflective of the fact that tariffs will most likely result in a one-time boost to inflation through companies passing on higher costs but should not cause long-term stickiness. Similar to the pre-election period, short-dated real yields have decreased due to the expectation that the Fed will continue along its path of normalizing policy. While long-end real yields are rising as they did in the pre-election period, the story is much different this time. The increase in long-term real yields is occurring in tandem with increasing investor worry regarding the long-term fiscal health of the U.S. government, given the expectation of deficit-expanding tax cuts, coupled with the possible hits to economic growth from tighter immigration policy and restrictive tariffs. As a result, this upward climb in long-end real yields seems to be driven mainly by increasing term premiums.

Key Takeaway

When investing in government debt, knowing what you are being compensated for is critical. An informed investor should consider what the market is pricing against what they believe the future path is based on the current facts they have on hand. While the bond market has moved in the same way directionally both pre- and post-election, the narratives surrounding the moves have been quite different. While the post-election moves may prove to be correct, it is impossible to know until the new administration takes office and begins implementing policy. Until then, growth and employment data are holding up well and should support real yields at their current levels, given we do not see any deterioration in the data prior to year-end.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.