Credit Compression: The Story for 2024

December 5, 2024

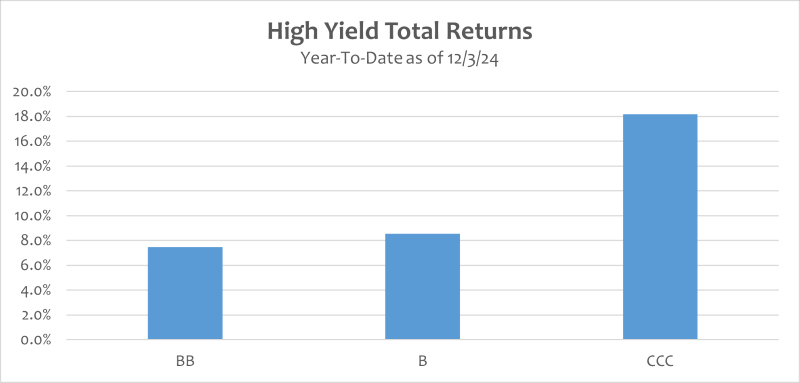

Low-quality credit has materially outperformed this year, following a strong 2023. In today’s Chart of the Week, the total returns for the CCC cohort exceeded BB bonds by over 1000 basis points (bps), according to the J.P. Morgan High Yield Index. CCC credit spreads tightened an impressive 201 bps per the J.P. Morgan High Yield Index, compared to 45 bps and 63 bps for BB and B, respectively.1 In other words, the junkier the better, in terms of alpha generation.

During the third quarter, as bullish sentiment gained momentum, the distressed part of the market — which had lagged during the first half of the year — started to catch up. These included some of the largest names in the index, such as DISH Network Corporation, CommScope, Lumen Technologies, Inc. and Altice USA. Liability management exercises (distressed exchanges) enabled many of these and other overlevered companies to avoid messy bankruptcies, causing the yield of newly exchanged and existing bonds in their capital structures to rally.

Key Takeaway

The market is set to exit the year on a solid fundamental and technical footing. Despite the massive compression in the market and some of the tightest high-yield spreads in almost 20 years,2 it is difficult to ignore the bullish macroeconomic narrative. There have been similar periods of calm in the mid-1990s and mid -2000s,3 reminding us spreads can remain tight for an extended period. As such, valuation (tight spreads) may not be a good predictor of short-term returns. I expect another positive year — a catalyst other than snug valuations will be needed to break the trend. At the index level, there is little opportunity to differentiate both in terms of quality and sector. With limited dispersion expected in 2025, it may be a true credit pickers market.

Sources:

1-2Bloomberg

3J.P. Morgan

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.