The Growth of Rule-Based Investing

December 19, 2024

In recent years, the exchange-traded fund (ETF) market has expanded significantly, offering a wide array of strategies, including volatility selling, options structures, leveraged long, short selling, and more recently, leveraged exposure to Bitcoin. These ETFs have pre-written trading rules to allocate capital based on market volatility, direction, momentum, etc. Alongside ETFs, there are other investment vehicles like Commodity Trading Advisor (CTA) funds, volatility-controlled funds, smart beta products and bank-provided quantitative investment strategies (QIS). These are collectively referred to as rule-based or quantitative investments.

Growth in rule-based strategies comes amid a shift in the asset management landscape with the rise of passive investments. Rule-based strategies offer asset managers an opportunity to innovate and generate additional fee income, increasing their prevalence and reshaping market dynamics.

Volatility-selling ETFs, such as those focused on covered call strategies, reduce market volatility. These ETFs generate income by selling call options to dealers. Dealers, in turn, hedge their long option positions by buying as markets decline and selling as they rise, stabilizing prices and suppressing volatility. For example, currently, if you sell $25 billion notional of S&P 500 Index, December 31 6055 call options, we would expect banks’ hedging activities to help pin the index around the 6055 level until its maturity on December 31.

In contrast, leveraged ETFs can amplify market volatility. Their structure requires them to buy more in rising markets and sell more in falling ones, often at the market close, amplifying price swings. For instance, in 2022, significant inflows into leveraged short ETFs likely helped accelerate market selloffs.1

Similarly, during the yen carry trade unwinding in August 2024, outflows from the WisdomTree Japan Hedged Equity Fund (a yen-hedged ETF) likely amplified the Japanese market downturns.2

Although these rule-based investing strategies can depress or amplify market volatility, money flows into/out of these funds, and the equity allocation in volatility control funds and CTAs are highly momentum-driven.

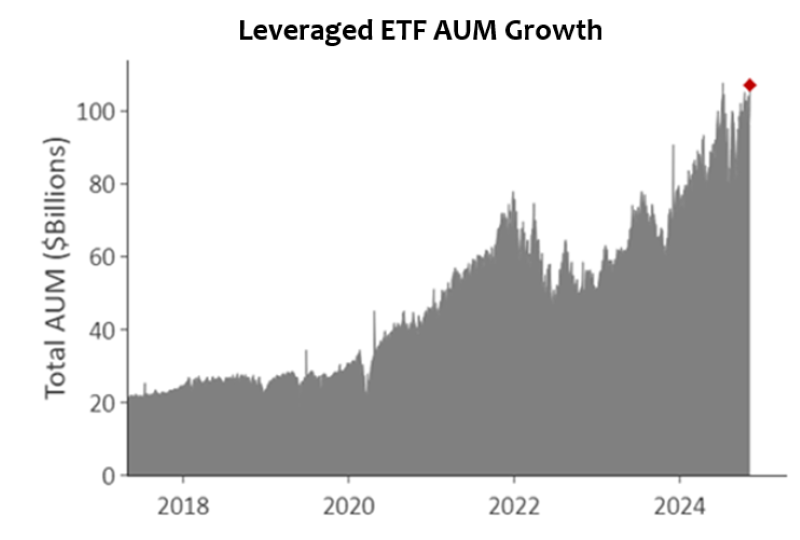

In 2022, there were large inflows into short selling and leveraged short ETFs during the market downturn. We also witnessed an increased popularity of buffer ETFs, which have more downside protection. During the bull market of 2024, leveraged long funds are attracting large inflows, as shown in today’s Chart of the Week. These funds were designed to amplify returns in a rising market. Single stock leveraged long ETFs also grew from 18 stocks in 2022 to 65 today.3

This behavior of chasing the best-performing ETFs extends market trends — quiet markets become quieter, while volatile markets grow more chaotic. Historically, active managers provided a counterbalance to such momentum, but their diminished role in the era of passive management has reduced this balancing effect.

Key Takeaway

The innovation in ETFs is giving retail investors a new set of tools. The adoption of these ETFs has been fast, and the fund flows have in general followed the performance of the last six to 18 months. The result is a self-reinforcing cycle: strong markets grow stronger, while weak markets may face more pressure.

Sources:

1Track in Sight – ETFs Charted - Leverage & Inverse ETFs Across the Atlantic; 8/1/24

2The Japan Times – Yen-hedged ETF suffers exodus of cash from carry-trade fiasco; 8/13/24

3Nomura Securities Equities Derivatives; December 2024

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.