More Room to Run?

January 9, 2025

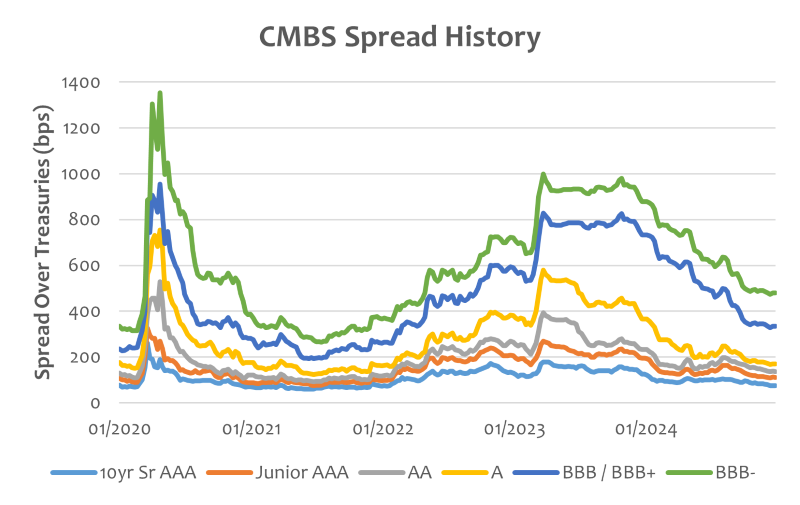

The commercial mortgage-backed securities (CMBS) market experienced robust demand across the capital stack in 2024 which drove credit spreads tighter. Issuance volumes finally rebounded last year with just over $100 billion recorded.1 As we begin 2025, CMBS credit spreads are sitting at their one-year tights.2 Despite widespread concerns about the commercial property sector last year, the market experienced strong bond inflows and investor demand, resulting in tighter credit spreads. In 2024, 10-year Sr. AAA spreads tightened by 51 basis points (bps), while spreads for BBB-rated securities tightened by 399 bps.3 Meanwhile, the spread pick-up between AAA and BBB-rated CMBS contracted by 405 bps.4

CMBS spreads narrowed all year despite steadily rising delinquency rates. Office performance has been the biggest driver of elevated delinquency rates,5 which are expected to continue to rise this year due to prolonged workout times, although at a slower rate. Credit fundamentals are likely to drive significant performance dispersion across commercial real estate property types in the near term. Higher-quality properties will likely be better insulated against the potential headwinds from elevated delinquencies and higher capitalization rates.

Resilient economic conditions and improving fundamentals away from office will likely benefit CMBS in 2025. Most property prices have found a floor, although it may take time for price appreciation to rebound. The primary market is expected to be even stronger this year driven by increasing transaction volumes, loan maturities and attractive spreads. Investor demand will likely also remain strong as CMBS spreads and all-in yields still look compelling.

Key Takeaway

While there are pockets of distress such as office, I see stronger fundamentals in most other sectors of commercial real estate where demand and supply drivers are balanced. Positive trends are emerging as commercial real estate prices appear to have bottomed and loan negotiations have changed the maturity landscape. Although CMBS spreads have come in this past year, valuation remains attractive both relative to its history and versus competing asset classes.

I expect some potential spread tightening this year; however, I remain more cautious down the capital stack. BBB-rated bonds carry elevated loss risk, and spreads are not as attractive on a loss-adjusted basis. I continue to maintain an up-in-quality bias as they offer a better risk-reward profile and look more appealing at current yields.

Sources:

1Trepp – End of Year Wrap-Up: Trepp's Top Five Blogs of 2024; 12/27/24

2-4J.P.Morgan; Data as of 12/26/24

5Trepp – CMBS Research; December 2024

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.