2025 – M&A Boom?

January 23, 2025

2024 was a fantastic year across the public markets as the S&P 500 Index finished up approximately 25.0%, and the Nasdaq 100 Index finished up approximately 28.0%. Given the strong performance of the stock market, one might think that dealmaking and mergers and acquisitions (M&A) also flourished in 2024 — however, that would not be true.

Coming into 2024, investors seemed optimistic that interest rates would fall, the bid-ask spread between buyers and sellers would continue to tighten and the regulatory environment would become more favorable, spurring M&A across both the public and private markets.1 Unfortunately, interest rates did not come down enough to incentivize dealmaking, and a number of would-be acquisitors decided to sit out the year as the presidential election loomed and the possibility of a more business-friendly regulatory environment awaited in 2025. In addition, public market valuations (enterprise value-to-EBITDA) increased 19% for the S&P 500 Index in 2024, compared to the prior year,2 making potential acquisitions much more expensive.

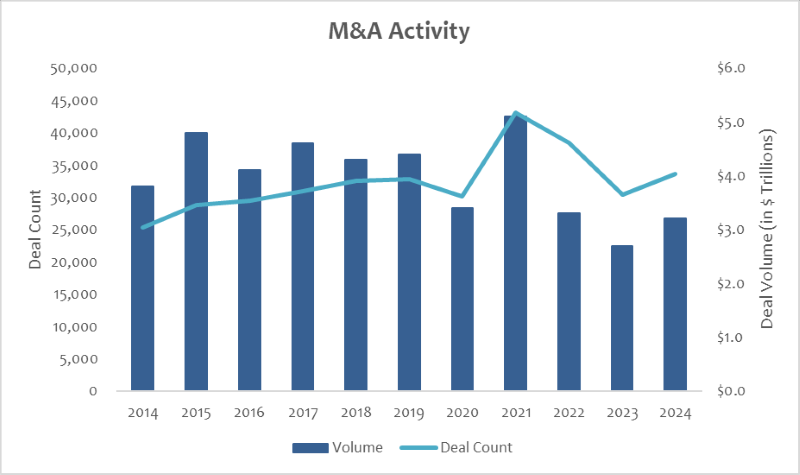

Furthermore, the level of M&A activity last year amounted to roughly $3.3 trillion, slightly below the deal value transacted in the mid-2010s.3 From a sector perspective, there was significant bifurcation as energy and natural resources saw the greatest number of acquisitions valued at over $1 billion in size, while healthcare and life sciences saw the fewest.4 In total, energy and natural resources saw more than 10 mega deals (deals valued at greater than $5 billion) in the first 11 months of 2024, continuing the wave of consolidation across the industry.5 Other industries typically known for a significant amount of M&A activity, such as technology, still lagged far behind as interest rates remain top of mind, and growth has slowed when looking back just a couple of years ago.6

Looking to 2025, Stephan Feldgoise and Mark Sorrell, the co-heads of global M&A business at Goldman Sachs, say there are signs that dealmaking will accelerate this year. Sorrell says, “The next 12 months will be a better environment for, particularly, large dealmaking activity than the previous 12 months, because of [the] risk appetite, financing environment, regulatory conditions, geopolitical conditions.”7 In addition, in the private markets, private equity sponsors have significant amounts of dry powder to deploy and are focused on returning capital to investors. The avenues for liquidity for investors in these funds have expanded over the past couple of years, as general partners have returned capital via sponsor-to-sponsor sales, minority stake transactions and continuation fund vehicles.

Further bolstering the positive M&A outlook for 2025, on Morgan Stanley’s most recent earnings call, CEO Ted Pick cited that the global M&A backlog he sees for 2025 is the largest it’s been in seven years as there is demand for “some corporates to get bigger."8 In addition, Pick mentioned that boardroom confidence continues to grow as valuations stabilize and financing markets remain healthy.9 Finally, Pick also commented on several companies exploring initial public offerings (IPOs) as public equity investors look for new opportunities to invest in and corporations look to catalyze value outside of the private markets.10

Key Takeaway

2024 was a great year for public equity investors, but M&A did not come back in a way that many had envisioned. Given the uncertainty around interest rates, monetary and regulatory policy, as well as valuations, dealmaking remained somewhat subdued.

However, looking at 2025, many CEOs and investors have confidence that 2025 will be a great year for M&A. As interest rates continue to fall, the new administration provides clarity on the business environment, valuations continue to normalize and corporations continue to think about how to grow their business, acquisitions appear to be a key area of discussion as we head into February. Will it materialize? It is difficult to say, but confidence appears to be high, and given all the positive momentum mentioned above, I would not be surprised to see a strong year for dealmaking in 2025.

Sources:

1,2,4-6Bain & Company – Looking Back at M&A in 2024: Dealmakers Adapt as the Market Idles; January 2025

3Bloomberg

7Goldman Sachs – Global deal-making is expected to gain momentum in 2025; 12/18/24

8-10Morgan Stanley Q4 2024 Earnings Call; January 2025

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.