A Bankrupt Bunch

January 30, 2025

Each year comes with its own big bankruptcy stories, and 2024 was no exception. Notable bankruptcies the past year included Big Lots, Party City, Express, Red Lobster, Joann Fabrics, Spirit Airlines and The Container Store.1 Financial stress ultimately overwhelmed these companies, resulting in an inability to pay back their debt. Bankruptcy may be the end for some companies; however, for others, it may be a way to restructure. Often, a company that files Chapter 11 bankruptcy will be able to stay in business through a reorganization and restructure of its finances. The companies listed above mostly involve the latter. For example, The Container Store filed for bankruptcy on December 23, 2024, and Chief Executive Officer Satish Malhotra said the company "is here to stay" and intends to be a private company once it completes the Chapter 11 process.2

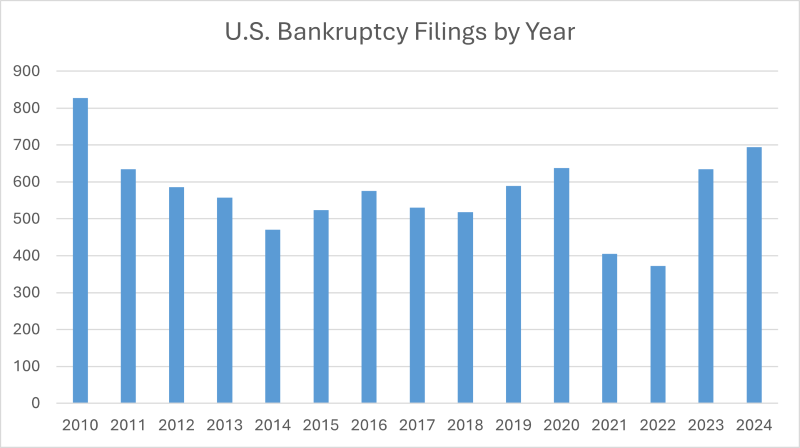

As seen in today’s Chart of the Week, corporate bankruptcies totaled 694 in 2024, up 8.0% from the prior year, resulting in the most U.S. bankruptcy filings in 14 years and the largest single-year tally since the fallout from the Great Recession.3 The significant rise in corporate bankruptcies was attributed to a combination of high interest rates, too much debt and increased costs due to inflation. Financial issues from bankruptcies are also specific to each company. A topical issue observed from Red Lobster was their shrimp promotion, where offering an endless shrimp deal, coupled with inflationary pressures, unfavorable leases and underperforming locations, ultimately led to the filing. However, Red Lobster has now emerged from Chapter 11 on a better track with new management closing underperforming locations, improving the brand and eliminating the shrimp promotion.4 The retail industry also continues to face challenges, as evidenced by bankruptcies from Big Lots, Express, Party City, The Container Store, and Joann Fabrics.5 A common issue across these companies is increased competition, particularly from major retailers like Walmart and Amazon, which offer similar products. This situation illustrates Porter’s five forces, a framework for analyzing the competitive forces in an industry, and the threat of substitutes as big-box retailers sell comparable goods and intensify market pressures.

Key Takeaway

In 2024, corporate bankruptcies increased, with several well-known U.S. retailers and businesses among those filing. Poor execution, high interest rates, inflation and heavy debt burdens drove the higher number of filings. While the rise in bankruptcies is notable, borrowing conditions may improve if the Federal Reserve pursues further rate cuts, though this may occur more gradually than originally anticipated, depending on policy decisions.

Sources:

1,5Bloomberg

2Modern Retail – Party City and The Container Store add to a spike in retail bankruptcies in 2024; 1/3/25

3S&P Global – US corporate bankruptcies soar to 14-year high in 2024; 61 filings in December; 1/7/25

4Restaurant Dive – Red Lobster expects positive net income by fiscal 2026; 7/25/24

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.