AI Capex Will Continue, Despite DeepSeek Roll Out

February 6, 2025

The artificial intelligence (AI) world was recently upended with the release of Chinese AI company DeepSeek’s R1 model. On January 10, DeepSeek, which emerged from the Chinese hedge fund High-Flyer, released its first free chatbot app for iOS and Android.1 By January 27, the app surpassed ChatGPT as the most downloaded free app in the iOS App Store.2 Its introduction and backstory sent shockwaves through the entire AI infrastructure — including public and private investors, technology companies big and small, chip companies, data centers and utilities. Much of the panic centered around the efficiency of DeepSeek. The model performs well against models made by U.S. companies, was developed for considerably less money and required considerably less computing power than its competitors did to be developed. The market impact of the model roll out was swift. As of market close on January 27, the threat posed by the efficiency of DeepSeek on various industries caused the Nasdaq Composite to decline by 3.1% in a single day.3 Individual company decliners included computer software company Oracle, which fell 14%, nuclear power company Constellation Energy, which fell 21%, and chip maker Nvidia, which fell 17% — erasing nearly $600 billion of its market value.4

DeepSeek’s open-source R1 AI model matches reasoning tasks at the same level as OpenAI-o1, which was released in December 2024. According to DeepSeek, it spent $6 million5 (versus an estimated $63 million development cost of ChatGPT-4 according to TeamGPT)6 to develop and train its V3 model, R1’s predecessor. The company reportedly utilized 2,000 Nvidia H800 chips, and the entire process took approximately two months. The H800 chip is a modified version of Nvidia’s flagship H100 chip that was designed to comply with U.S. export controls released in 2022. These controls were intended to freeze China's development of supercomputers used to create nuclear weapons and AI systems. DeepSeek has not released the cost of developing and training its R1 model. According to Medium, the company had access to roughly 50,000 chips, including H100s that it stockpiled prior to the trade restrictions being enacted, H800s and H20s — another lower-performance Nvidia chip designed for the Chinese market. How or if these chips were utilized in training the R1 model is unclear. Medium estimates the cost to train the R1 model was approximately $1.6 billion.7

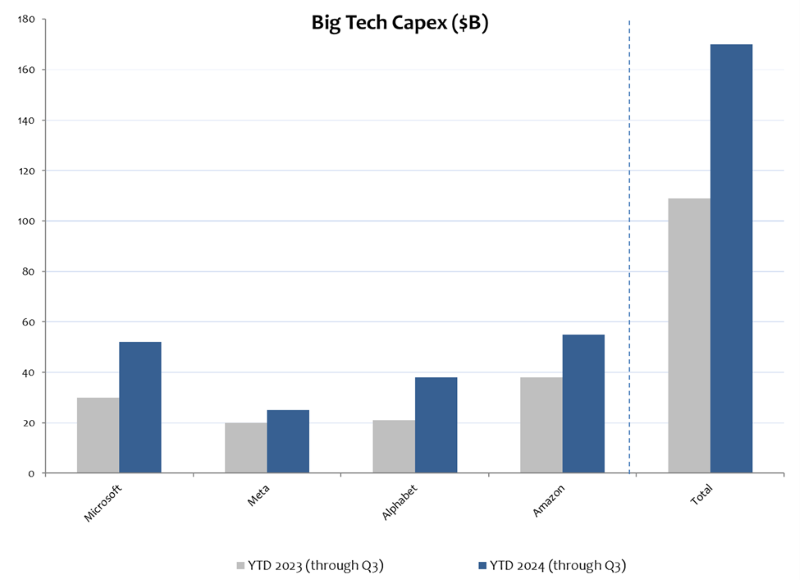

DeepSeek’s efficiency has sent a strong warning to U.S.-based companies that operate across the AI landscape. Big tech firms have traditionally justified massive spending on AI infrastructure, citing the need for extensive hardware and energy to train large models. However, DeepSeek’s ability to develop advanced models with greater efficiency, even considering the uncertainties around the actual cost and infrastructure used to train the R1 model, challenges these assumptions. Tech giants Microsoft, Meta, Alphabet and Amazon alone, for example, accounted for $170 billion of capex spending — predominantly for AI infrastructure through the third quarter of 2024 — a 56% increase from the same period in 2023.8 According to CB Insights, venture investors invested $76.3 billion in U.S. AI startups in 2024.9 AI spending is expected to exceed a quarter trillion dollars in 2025 — a number that will likely be surpassed.

Now that some of the dust has settled from its introduction, it appears that while DeepSeek’s approach will likely reduce the cost of developing AI models, its advantages are unlikely to remain exclusive for long as global AI leaders rapidly adapt new efficiency breakthroughs. It also does not appear to have changed the plans for U.S. technology companies to spend hundreds of billions of dollars on AI infrastructure in the coming years. On a call with analysts last Wednesday, for example, Meta Chief Executive Officer Mark Zuckerberg said Meta is still digesting some of DeepSeek’s feats, and his team hopes to eventually implement some of those advancements for their own AI projects — and dismissed the notion that Meta’s overall AI spending will drop.10 Further, Microsoft Chief Financial Officer Amy Hood vowed to continue investing in AI technology and said that its capital spending in the third and fourth quarters of fiscal year 2025 (which ends in June) would remain around the level seen in the second quarter ($22.6 billion).11

Key Takeaway

The introduction of the DeepSeek app was a shot across the bow for all of the players in the AI space. While many of the details surrounding its R1 model remain murky and quite possibly exaggerated, it’s clear that there is an arms race of sorts in the AI space. Innovation can come from anywhere, regardless of company size, domicile or perceived limitations — and will continue to do so. Big tech players continually look for ways to optimize their models — and this may have been the shake-up that was needed for them to remain vigilant in their pursuit of attaining efficiencies — realizing that if they don’t find those efficiencies, someone else will.

Sources:

1Yahoo! Finance – Chinese AI chatbot's rise slams US tech stocks; 1/28/25

2-4Investopedia – Markets News, January 27, 2025: Nasdaq Composite, S&P 500 Tumble on Concerns About China's AI Advances; Tech Sector Has Worst Day Since 2020; 1/27/25x

5,7Medium – New Report Debunks DeepSeek’s Supposed Cost Advantage Over ChatGPT; 1/31/25

6Team GPT – How Much Did It Cost to Train GPT-4? 7/12/24

8Forbes – AI Spending To Exceed A Quarter Trillion Next Year; 11/14/24

9CB Insights – What DeepSeek’s model releases mean for the future of AI; 1/28/25

10CNBC – Zuckerberg says Meta won’t slow down AI spend despite DeepSeek’s breakthrough; 1/29/25

11Investing.com – Microsoft, Meta back big AI spending despite DeepSeek's low costs; 1/29/25

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.