Why Are Corporate Spreads So Tight?

February 20, 2025

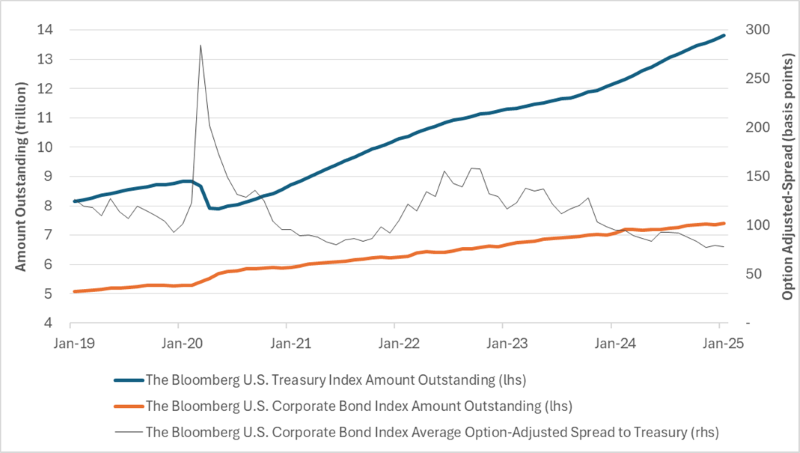

On November 8, 2024, the Bloomberg U.S. Corporate Bond Index’s average option-adjusted spread (OAS) to Treasuries hit a 20-year low of 74 basis points (bps).1 Since then, the index average OAS has hovered around 80 bps. Despite volatility in both interest rates and equities, corporate credit markets have remained remarkably resilient.

Average corporate OAS is a widely used measure of credit spreads, representing the yield premium corporate bonds offer over Treasuries of similar maturities. A higher spread indicates that investors demand a greater discount relative to Treasuries to compensate for corporate credit risks. Corporate OAS reflects the relative value proposition between corporate bonds and Treasuries.

Several fundamental factors explain today’s historically tight credit spreads, including a healthy economy, strong corporate balance sheets and robust demand from income-focused investors. However, another critical factor is the growing supply imbalance between corporate bonds and Treasuries, which is reshaping their relative value dynamics.

As illustrated in today’s Chart of the Week, the total outstanding amount of bonds in the Bloomberg U.S. Corporate Bond Index has increased by $2.3 trillion since 2019, while the total outstanding amount in the Bloomberg U.S. Treasury Index has surged by $5.7 trillion.2 Consequently, Treasuries now comprise 44% of the Bloomberg U.S. Aggregate Index, up 5% from 2019, whereas corporate bonds have declined to 24%, down 1%.3 This indicates corporate bonds have become scarcer relative to Treasuries, tightening credit spreads.

The U.S. government has significantly expanded fiscal spending since the COVID-19 pandemic, leading to a cumulative fiscal deficit of over $10 trillion in the past five years.4 This deficit has been primarily financed through Treasury issuance. While the Bloomberg U.S. Treasury Index does not include all outstanding Treasuries, it remains a strong proxy for the investable Treasury market. In contrast, higher interest rates have discouraged corporations from aggressive public borrowing as they seek to avoid excessive interest costs.

This shift in relative value is also evident in derivatives markets. The spread between the 10-year Treasury yield and the 10-year secured overnight financing rate (SOFR) swap rate has widened from around 20 bps in 2020 to over 40 bps recently.5 If we consider the 10-year SOFR swap rate as the true risk-free rate, this suggests that the rising term premium — a key risk premium in Treasuries — is likely linked to the increasing supply of government debt.

Key Takeaway

Corporate credit spreads relative to Treasuries remain historically tight. While strong corporate fundamentals play a significant role, relative value dynamics between corporate bonds and Treasuries are also an important underlying factor. The rapid increase in Treasury supply has incrementally reduced their attractiveness compared to other fixed-income assets. Instead of corporate bond risk premium shrinking, it is possible that some of the risk premium has simply migrated into the Treasury market as investors demand greater compensation for holding government debt.

Sources:

1-5Bloomberg

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.