Exploring the Effect of Fund Size on Private Equity Results

March 6, 2025

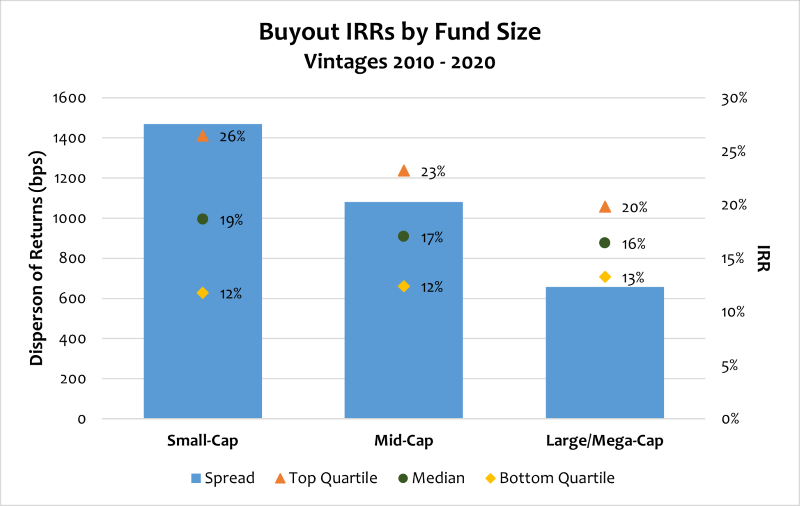

There has been an ongoing discussion among investors who allocate to private equity (PE) about the advantages and drawbacks of different fund sizes, with buyout funds commonly categorized as either small-cap, mid-cap or large/mega-cap. While larger funds often garner more attention due to their size, market presence and high-profile deals, a closer look reveals that small-cap buyout funds have the potential to deliver superior returns over time. As shown in today’s Chart of the Week, when examining funds incepted between 2010 and 2020, median and top quartile small-cap buyout funds — defined as those with a fund size below $1 billion — have outperformed funds focused on mid-cap and large/mega-cap companies by a material margin. However, as is always the case, higher potential returns come with higher risks. This is evident in the notably wider dispersion between the top and bottom quartile performance of small-cap funds compared to their larger counterparts.

Perhaps one of the most compelling reasons for the superior performance of small-cap, also known as lower middle-market (LMM), buyout funds historically is their exposure to higher growth opportunities. That is, smaller companies generally have more room to grow compared to larger businesses, which may already have captured substantial market share and reached maturity in their industries. LMM companies often operate in niche markets where demand is rising, giving PE investors the chance to capitalize on organic growth, operational improvements and strategic acquisitions.

Companies in the LMM are often founder or family-owned and may be seeking partial or full liquidity and/or a strategic partner who can help guide the company through its next phase of growth. These businesses can often benefit from investments in new talent, technology and systems, sales and marketing and operational resources that the founder or family didn’t have access to previously. With the right management and capital investment, these companies can scale rapidly, offering greater return potential for fund managers and their investors.

Privately owned small-cap companies also frequently trade at lower valuation multiples compared to their larger counterparts, creating an attractive entry point for investors. Lower acquisition multiples provide greater room for value creation through operational improvements, revenue growth, strategic acquisitions and multiple expansion upon exit. This hands-on value creation contrasts with large-cap buyouts, which sometimes rely more heavily on financial engineering and cost-cutting measures rather than fundamental business transformation. The value creation process in the LMM is generally more active and closely linked to improving the acquired company’s operational performance and strategic positioning.

Another factor driving the outperformance of LMM buyout funds is the broader range of exit opportunities they can pursue. These funds can exit their investments through strategic sales to mid-sized companies, larger PE firms or even through an initial public offering (IPO). The potential for exits through both strategic and financial buyers distinguishes small-cap buyouts from their larger counterparts, which may face more limited exit options given the size and maturity of their investments.

Despite the strong return potential, LMM buyout funds exhibit wider dispersion in returns compared to larger funds. The increased risks associated with investing in smaller companies — such as limited access to capital, greater operational vulnerabilities and heightened exposure to market cyclicality — contribute to a broader range of possible outcomes. While these risks are a natural consequence of investing in companies with less certain growth trajectories, they are also a key driver of the potential for outsized returns. Lastly, given the smaller size of the funds, they’re often more difficult to find and access, as the most attractive funds may be oversubscribed or lack the capacity for new investors.

Key Takeaway

The outperformance of small-cap buyout funds relative to mid- and large/mega-cap funds between 2010 and 2020 highlights their appeal to PE investors. Their higher growth potential, ability to capitalize on valuation inefficiencies, hands-on management approach and diverse exit opportunities create a compelling investment case. While large-cap buyouts may offer stability and scale, small-cap funds remain a powerful engine for generating outsized returns in PE portfolios. That said, both can make sense depending on the goals, objectives, resources and size of the investor.

LMM buyouts carry higher investment and operational risks due to size and market position. As a result, proper due diligence and manager selection are critical in identifying and accessing top-performing funds while avoiding underperformers. Investors in PE funds must determine the manager’s edge by assessing their track record, industry expertise and ability to drive operational improvements to increase their chances of achieving superior returns.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.