A Penny Saved is a Penny Earned

March 13, 2025

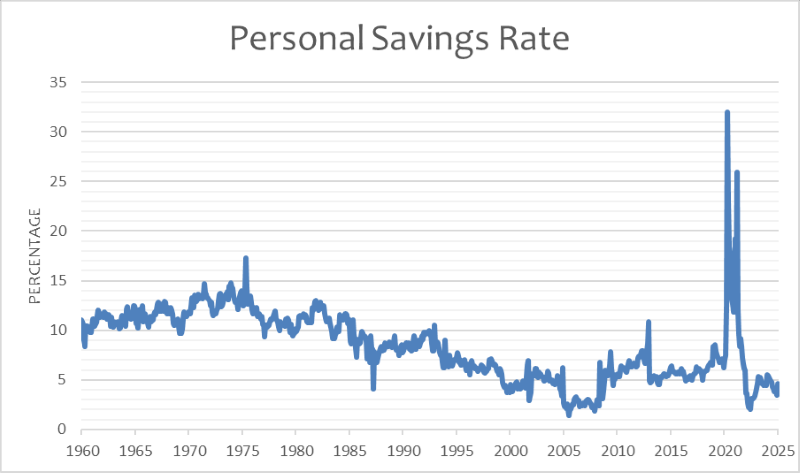

The U.S. personal savings rate, which depicts personal savings as a percentage of disposable income, increased to 4.6% in January 2025 from 3.5% in December 2024.1 While this marks the highest level of savings since last June, at which time the savings rate was 4.8%, it remains well below the long-term average of 8.4% and more than 100 basis points below the more recent 2013-2019 average of 5.9%.2

The savings rate peaked in excess of 30% in 2020 and remained elevated through mid-2021 amid COVID-19 restrictions and social distancing — which limited consumer spending — coupled with government stimulus.3 The Federal Reserve reported that U.S. households accumulated approximately $2.3 trillion in savings during that time.4 Since then, however, the savings rate has retreated, flirting with historic lows experienced in the years leading up to the Great Recession. This lower personal savings rate helped the economy to remain robust over the past few years in the face of inflationary pressures and higher interest rates.

While the recent savings rate is relatively low, it has been influenced by a unique set of circumstances that, taken together, make it less comparable to historical rates. One factor to consider is the level of stimulus injected into the system in 2020 and 2021. The extraordinary savings during that period may have allowed people to spend a higher percentage of their earnings in the subsequent years. Additionally, employment has been robust in the post-COVID-19 era, which may compel individuals to feel more confident about spending. Even with the most recent unemployment print ticking up to 4.1%,5 we are still well below historical averages over the past 20 years.6 Also, the strength in the stock market and increased home values may cause individuals to feel wealthier and, therefore, more comfortable spending a larger portion of earnings.

Key Takeaway

The personal savings rate provides insight into consumer behavior and financial well-being. Recent figures rank among the lowest on record. With last week’s reports indicating that planned February layoffs were the highest of any February since the Great Recession,7 along with a decline in equity markets, it will be interesting to see if these factors lead to a noticeable shift in the savings rate in the coming months.

Sources:

1-3FRED Economic Data – Personal Saving Rate; March 2025

4Board of Governors of the Federal Reserve System – Excess Savings during the COVID-19 Pandemic; 10/21/22

5U.S. Bureau of Labor Statistics – Employment Situation Summary; 3/7/25

6U.S Bureau of Labor Statistics – Civilian unemployment rate; March 2025

7Challenger, Gray & Christmas, Inc. – Job Cuts Surge on DOGE Actions, Retail Woes; Highest Monthly Total Since July 2020; 3/6/25

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.