Resiliency Remains for IG Credit

March 20, 2025

Last week, investment-grade (IG) corporate bond spreads were six basis points (bps) wider, though three bps better than the year-to-date wides set on Thursday. Corporate bonds are up approximately 1.7% year-to-date, while the S&P 500 Index is down over 4.0% for the same time period and down 8.22% from the all-time highs set in mid-February.1

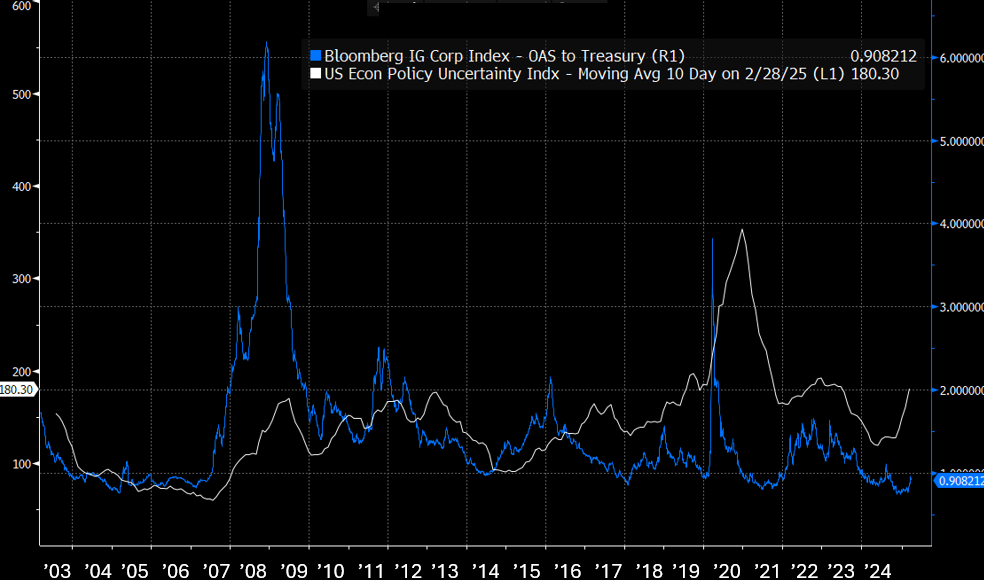

The equity markets, in particular, seem to be expressing more unease about the impact of new Trump administration policies — most notably tariffs and the effect on future growth. The on-again/off-again nature of the tariff shifts have only added to the weakness. Meanwhile, IG credit spreads have remained relatively resilient. As displayed in today’s Chart of the Week, spreads — while weaker on the year — remain near the post-Global Financial Crisis tights despite the recent jump in economic policy uncertainty. The technical backdrop for IG corporate bonds remains supportive, with yields around 5.25% and still above the six-month average.2

Federal Funds Futures are now pricing in almost three interest rate cuts by year-end given the recent deterioration in business and consumer sentiment.3 Last week, airlines and retailers joined a growing list of companies lowering guidance and emphasized the difficulty of planning, including capex and hiring, amid the uncertainty. Following yesterday’s Federal Open Market Committee rate decision, the dot plot and Chair Powell’s comments appear to support the market’s rate outlook. In addition, it appears the Federal Reserve sees the labor market as in balance and will be proactive and not wait for weakness to materialize in the payroll data before beginning to lower rates.

Key Takeaway

Demand for IG corporate credit continues to be robust, and yields remain appealing. While spreads have experienced some weakness, it has been fairly orderly and benign compared to equity risk markets. Undoubtedly, there is more uncertainty to come regarding the economic growth path given the aggressiveness of the new administration’s policy to this point. Over time, I anticipate IG credit investors will somewhat adapt to policy uncertainty and concentrate more on the longer-term economic impacts. To the extent growth slows and progress on inflation is challenging, I expect corporate credit spreads to feel additional pressure.

Sources:

1-3Bloomberg

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.