It’s Electric – Data Centers on Track for Record-Setting Year

March 27, 2025

The origin of data centers, or physical locations for information technology infrastructure, can be traced back to the 1940s. The Electrical Numerical Integrator and Computer, completed in the mid-1940s, spanned a 1,500 square-foot basement at the University of Pennsylvania and used a programmable plug board to perform up to 5,000 additions per second, sometimes taking multiple days to prepare for a new calculation.1

Today’s data centers and their campuses can reach millions of square feet and feature complex, often redundant, cooling and power systems to support server racks performing a myriad of computing and storage tasks. The popularity of modern data centers has grown alongside rising demand for data storage, computing power, artificial intelligence (AI) and 5G.2 In recent years, data center owners and operators have increasingly turned to asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS) markets to finance their portfolios.

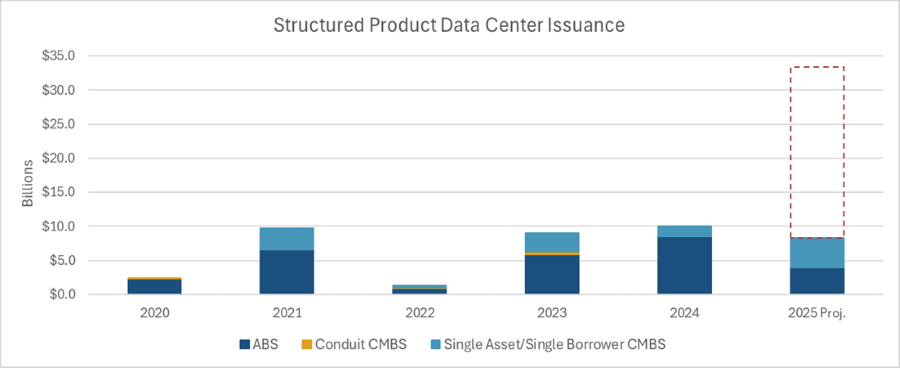

Today’s Chart of the Week highlights the growth of structured product new issuance backed by data center assets. With over $8 billion in structured product data center pricing in 2025 so far, less than $2 billion shy of full-year 2024 issuance for the asset class, annualized supply is on pace to exceed $30 billion by year-end. Robust issuance may be bolstered in the near term, as new data center construction in 2025 could achieve more than 10 times the levels reached in 2020 across the most populated markets.3 These same markets saw record-low 2.8% vacancy rates in 2024,4 a positive sign that newly constructed data centers may be absorbed efficiently and well-occupied before potential securitization in the ABS and CMBS markets.

Large, investment-grade companies such as Meta, Amazon, Alphabet and Microsoft have announced their projected spending on AI technology and data centers alone could reach up to $320 billion this year, a substantial increase from $230 billion in 2024.5 This is in addition to investments from other retail, colocation or hyperscale tenants that also utilize data center space.

Despite positive supply technicals and demonstrated market demand for a quickly growing asset class, headwinds and headline risks remain. Rising construction volumes increase the risk of overbuilding, particularly in speculative developments without pre-leased tenants.

Data centers also face the unique challenge of requiring signed leases and access to large amounts of reliable power to operate and generate securitizable cash flow. As more data centers come online, power grids may be stretched thin and require investment. Goldman Sachs Research estimates $720 billion in spending may be needed for the global power grid through 2030, with many projects taking years to complete.6 In the technology industry, which is known for innovations and disruptions, today’s forecasts and predictions could quickly become obsolete.

Key Takeaways

While uncertainty surrounds the future of data center needs, availability and performance as a structured product asset class, I see healthy fundamentals in the near term and strong relative value for well-located, well-leased assets with experienced ownership. Developments across all aspects of the data center universe, including leasing trends, industry standards and key inputs, should be closely monitored. Investors can expect some volatility driven by headlines and innovation as data centers become an increasingly investable asset class across both ABS and CMBS markets.

Sources:

1Encyclopedia Britannica – Electronic Numerical Integrator and Computer; 3/20/25

2-4CBRE – Data Centers: U.S. Real Estate Market Outlook 2025

5CNBC – Tech megacaps plan to spend more than $300 billion in 2025 as AI race intensifies; 2/28/25

6Goldman Sachs – AI to drive 165% increase in data center power demand by 2030; 2/4/25

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.