The World Turned Upside Down

April 10, 2025

Today’s title is one of my favorite lines from my favorite musical, Hamilton, referencing the American colonies’ liberation from the mighty British Empire. While the changes wrought via Liberation Day circa 2025 are not as consequential as the Revolutionary War, they do represent, if nothing materially changes, a significant reordering of the global trading and economic system that has been in place for decades.

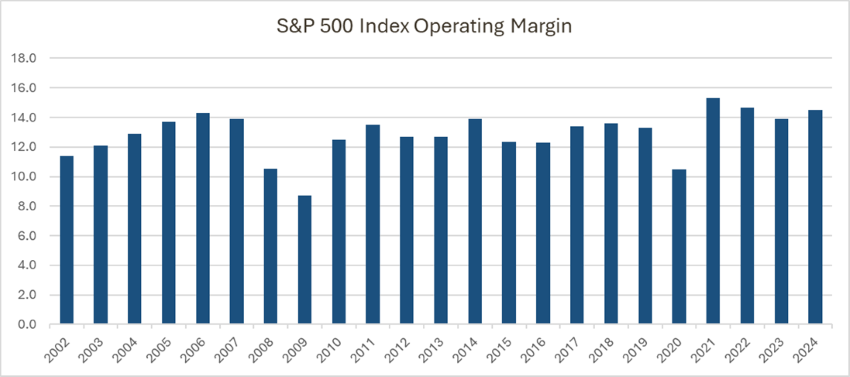

Analysis of first-and second-order effects show that margin compression may be the most pressing issue for leveraged credit. Today’s Chart of the Week shows the solid margin environment U.S. companies have been enjoying since the pandemic and relative to the last few decades. Management teams have benefited from lower input costs, efficient supply chains and disciplined expense management.

The new economic environment will likely lead to a combination of revenue weakness and higher cost of goods sold, reversing that trend. Earnings estimates are expected to decline, and forward guidance may remain vague. On a positive note, high-yield corporate balance sheets are in reasonably good shape, the maturity wall in 2025 and 2026 is manageable and the Federal Reserve will likely step in to lower rates. Global trade tensions may also ease with potential compromises.

Key Takeaway

In this risk-off environment, decompression has returned with a vengeance, as lower-quality credit is materially underperforming. The more speculative credits, those with numerous add-backs, pro forma adjustments and anticipated synergies baked into their numbers, will need to hustle to help offset the potential for future margin pressure. The clock is ticking.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.