Tariff Uncertainty Increases Pressure on the U.S. Consumer

April 24, 2025

The U.S. consumer has been remarkably resilient over the past several years. Strong employment, along with higher household income bolstered by rising home equity and a strong stock market, has allowed Americans to keep up with their growing debt. According to the Federal Reserve Bank of St. Louis, household net worth is up 45% since the fourth quarter of 2019.1

Despite positive trends, concerns are mounting about consumer health amid recent market volatility and yet-to-be-determined effects of tariff policies. The implications for the U.S. consumer may be widespread, which may put a strain on household liquidity, spending power and increase credit risk. Consumers are growing more pessimistic about the economy and feeling uneasy about future income. The recent consumer sentiment index fell to an almost three-year low amid concerns surrounding tariffs and future inflation.2

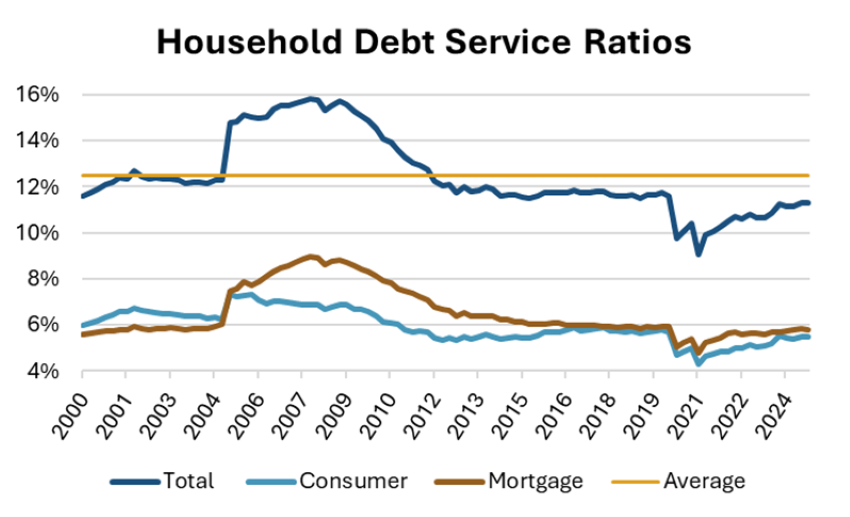

As U.S. households navigate a changing financial landscape marked by rising interest rates and inflationary pressures, debt service ratios can provide insight into the health of the consumer. Today’s Chart of the Week depicts the household debt service ratio measured by the percentage of disposable income allocated to servicing debt. This ratio measured 11.3% as of the fourth quarter of 2024, up from 9.08% in the first quarter of 2021, and has been relatively stable in the past several years. The increase in interest rates in recent years has likely contributed to the rise as borrowing costs for auto loans and credit cards have increased. While the recent trend is upward, the current total debt service ratio is still lower than the peak reached before the Global Financial Crisis of 2008-2009, when it fluctuated between 15% and 16%. While debt levels are rising,3 the burden of debt payments relative to income appears to be manageable.

Tariff repercussions could be a drag on consumer spending. Consumers may be more deliberate with spending and put off larger purchases or non-necessities, leading to a decline in discretionary spending. Purchasing power may weaken, and the affordability of goods and services may put further downward pressure on savings.

Within the asset-backed securities (ABS) market, many securitizations — such as auto, credit card and consumer loans — are tied to the consumer. Sectors exposed to subprime borrowers may be more susceptible to credit deterioration in a weakening economic outlook. Delinquencies for auto loans and credit cards have been steadily rising in recent quarters.4 However, ABS remains a defensive sector that is typically shorter in duration, with significant structural protections in place to withstand relatively high levels of defaults before principal loss, especially for senior bonds.

Key Takeaway

While consumer debt balance continues to rise, household leverage has stabilized slightly below pre-pandemic levels, indicating that U.S. consumers are managing debt effectively. Although overall credit fundamentals for consumer credit remain sound, I am more cautious on consumer credit ABS as performance may deteriorate this year. Significant headwinds remain due to policy uncertainty and an overall potential for a softening in the economy. I maintain an up-in-quality bias in ABS market securitizations tied to prime borrowers. Strong underwriting in recent years should support performance in a potential downturn relative to other asset classes.

Sources:

1Federal Reserve Bank of St. Louis – Households; Net Worth, Level; as of 2024

2University of Michigan – Survey of Consumers; April 2025

3,4Federal Reserve Bank of New York – Household Debt and Credit Report; Q4 2024

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.