Stablecoins Are Powering the Future of Finance

September 25, 2025

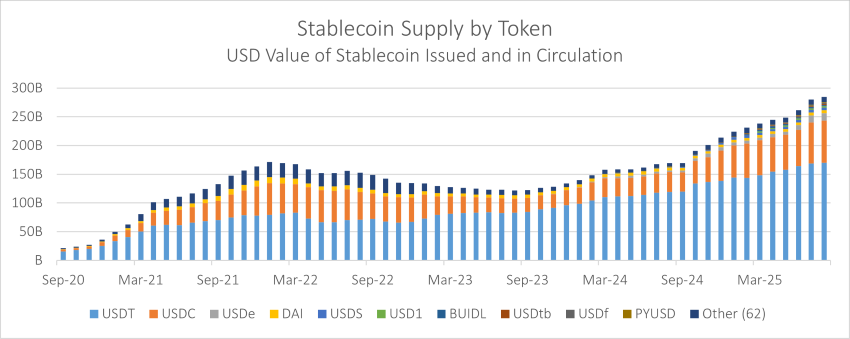

Stablecoins represent an emerging bridge between traditional finance (TradFi) and the digital economy, offering the stability of fiat currency with the efficiency of blockchain technology. These digital assets are designed to maintain a stable value by being pegged to reserve assets, most often the U.S. dollar. Unlike volatile cryptocurrencies like Bitcoin or Ethereum, stablecoins aim to minimize price fluctuations, making them practical for everyday transactions, cross-border payments and as a store of value. As highlighted in today’s Chart of the Week, the total supply of stablecoins is approaching $300 billion, with the two dominant players, Tether's USDT and Circle's USDC stablecoins, accounting for approximately $244 billion.1

As the world becomes increasingly digitalized, stablecoins are finding critical applications in financial markets. They provide fast, low-cost infrastructure for sending funds internationally, allowing transfers to settle in minutes rather than days. In decentralized finance (DeFi), stablecoins provide liquidity and serve as collateral for lending and borrowing. Businesses can utilize them to streamline treasury operations and hedge against currency volatility, while emerging markets leverage stablecoins as alternatives to unstable local currencies. By offering round-the-clock availability, near-instantaneous settlement and programmable functionality through smart contracts, stablecoins are beginning to disrupt established payment networks like SWIFT and Fedwire.

Despite their promise, stablecoins face meaningful challenges. Regulatory uncertainty across jurisdictions continues to impose compliance burdens, and questions around reserve quality and transparency remain central to investor confidence. The dramatic collapse of Terra’s UST stablecoin in May 2022, when the token lost its peg and plunged to near zero along with its companion LUNA coin,2 illustrates the risks of novel instruments that rely on complex mechanics. In addition, the centralized design of most leading stablecoins raises concerns about censorship resistance and potential single points of failure. Yet progress is being made. The U.S. GENIUS Act, Europe’s MiCA framework and other global initiatives are introducing stricter requirements for reserves, disclosures and licensing, directly addressing concerns regarding transparency and systemic risk. At the same time, the technological foundations of the ecosystem are advancing, with networks like Ethereum, Solana and Avalanche deploying Layer 2 scaling solutions that cut fees, ease congestion and strengthen security.3

A wave of crypto-native firms associated with stablecoins and digital finance recently went public, underscoring the sector’s growing importance. Circle, the issuer of the USDC stablecoin, has seen its share price soar since its June 5 initial public offering (IPO), pushing the company's valuation to approximately $32 billion as of Sept. 23.4 Gemini, the cryptocurrency exchange founded by the Winklevoss twins, also made a successful Nasdaq debut earlier this month amid robust investor demand. Figure Technologies, a blockchain-based lending platform, is currently trading at approximately $41 per share as of Sept. 23, well above its IPO price of $25 on Sept. 11.5 Investor enthusiasm for these listings highlights the increasingly prominent role of stablecoins in shaping the future of payments and financial infrastructure.

Key Takeaway

Stablecoins have emerged as critical infrastructure for the digital economy, offering the stability of traditional currencies with the efficiency and programmability of blockchain technology. While recent regulatory clarity through legislation like the U.S. GENIUS Act and successful IPOs from companies like Circle, Gemini and Figure demonstrate growing institutional acceptance and maturation of the sector, the Terra Luna collapse serves as a permanent reminder that not all stablecoin mechanisms are created equal. The future success of stablecoins will depend on maintaining transparent reserve backing, navigating evolving regulatory frameworks and building trust through consistent performance. As adoption continues to accelerate across payments, DeFi and cross-border transactions, stablecoins are emerging as the key player in connecting TradFi with the blockchain-based economy of tomorrow.

Sources:

1Artemis Analytics – Stablecoins; September 2025

2Corpate Finance Institute – What Happened to Terra? As of September 2025

3McKinsey & Company – The stable door opens: How tokenized cash enables next-gen payments; 7/21/25

4CNBC – Circle Internet Group Inc; as of 9/23/25

5CNBC – Figure Technology Solutions Inc; as of 9/23/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.