Investors setting the bar low for global economic growth and corporate earnings represents the best news for financial asset performance as we enter 2019. Expectations have turned 180 degrees versus 2018, when market narrative focused primarily on improving prospects for synchronized global economic growth and double-digit profit growth. Numerous explanations have been offered for the dramatic shift in sentiment recently, but tightening liquidity conditions and fears of an overly “hawkish” Federal Reserve (Fed) top the list.

If Fed policy helped to create the problem, it now must be part of the solution. The Fed’s response to recent financial market stress (including increased risk of a yield-curve inversion) will set the course for equity and bond market performance this year. Declining commodity prices and continued tame inflation measures, even with tightening labor market conditions, argue for a Fed pause – at minimum – after five straight quarterly rate hikes.

I expect the Fed’s recent more “dovish” turn will mark the beginning of the end for the current tightening cycle. Damage to investor sentiment runs deep following dismal fourth-quarter performance, but gradual healing will occur if the Powell-chaired Fed avoids the historical playbook to overtighten and push the economy into a recession. U.S. equity market performance over the near-term represents a tug of war between attractive value and negative momentum. Ultimately, I expect value will be the winner as moderate economic growth combines with stable interest rates and inflation to restore investor risk appetite.

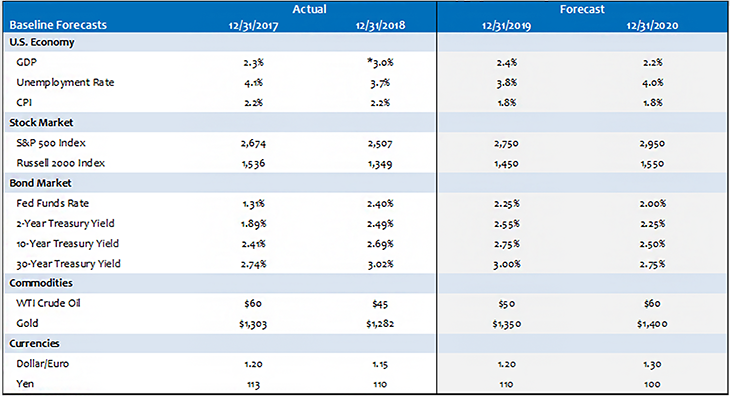

Exhibit 1. 2017 and 2018 Actuals; 2019 and 2020 Forecasts

*1-year as of 3Q18

Source: Bloomberg

To read our 2018 market and economic year-in-review, please click here. Remember to check the blog weekly for more market updates and investment ideas.

Index Definitions:

S&P 500 Index – An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large-cap universe.

Russell 2000 Index – An index measuring the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is comprised of 3,000 of the largest U.S. stocks.

All trademarks are the property of their respective owners.

Disclosures:

The views expressed in this material are the views of PMAM through the year ending December 31, 2018, and are subject to change based on market and other conditions. This material contains certain views that may be deemed forward-looking statements. The inclusion of projections or forecasts should not be regarded as an indication that PMAM considers the forecasts to be reliable predictors of future events. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate. Actual results may differ significantly.

Past performance is not indicative of future results. The views expressed do not constitute investment advice and should not be construed as a recommendation to purchase or sell securities. All information has been obtained from sources believed to be reliable, but accuracy is not guaranteed. There is no representation or warranty as to the accuracy of the information and PMAM shall have no liability for decisions based upon such information.