The Penn Mutual AM 1847 Income Fund (PMEFX) continues to generate strong performance for its shareholders. The portfolio management team highlights key differentiators of the Fund that has led to solid performance in a variety of market conditions.

"Patience and diligence, like faith, remove mountains."

William Penn, founder of Pennsylvania

Patience and diligence...diligence and patience. Simply climbing mountains can be quite tough, much less removing them. But if we equate the market’s worries, fears and risks with a mountain (a mountainous “wall of worry,” so to speak), then we see how patient and diligent investing can remove mountains from the investing landscape.

In terms of investing, sometimes the hardest thing is to be patient...to wait. “Cash is trash,” some like to say. This is generally true, unless all of the alternatives offer little value and there is higher potential for negative returns. The “holy grail” of investing is not to simply post high returns in good years for the market, but rather post solid returns over the course of the investment cycle, while exposing shareholders to less risk and lower drawdowns (a peak-to-trough decline during a specific period) in the worst of times. This critical point is often missed.

Being patient, and eschewing overpriced stocks and bonds, can be just as valuable as being fully invested all of the time. It requires an investment process that allows for flexibility, which PMEFX has, as well as persistent diligence even when it appears like we are not doing anything.

The truth is that we are always researching and looking for exceptional companies with great balance sheets run by successful management teams. The combination of patience and diligence is very powerful. It can remove mountains. It can help to achieve our shareholders’ goals over investment cycles no matter how momentous the time period, environment or market conditions.

Key Highlights for PMEFX

Flexible Asset Allocation — PMEFX is very different in a few key ways from other income and allocation funds. Many funds have a fixed or static asset allocation, also known as a “set-it-and-forget-it” strategy. This can generally work well when markets are stable and steadily rising. However, when markets become volatile or extremely overvalued, that strategy might not be good enough. Some markets require flexibility. PMEFX employs a dynamic, flexible asset allocation approach, with the only constraint being a 40% limit on common stock investments. The ability to go wherever we see the best combination of risk and reward is a key differentiator. If employed properly, this flexibility enables the Fund to add value in other ways beyond individual security selection.

Bottom-Up Investment Process — Our process is unique from a few different standpoints. The asset allocation is driven primarily from the bottom-up versus the top-down. We contend that starting from the bottom (screening what is currently undervalued across the income investable universe) is more of a controllable, repeatable process over the long term for such a strategy. It is much easier to identify the knowns from fundamental research than to gauge many higher-level factors from a top-down basis (e.g., the level of interest rates, stock market moves and sector selection). This perspective can provide some valuable insights, as it builds on individual company research and trends that can be observed across and within industries.

Independent Views — Our view of the investment world is driven by our own work, developed by internally generated research. The value tenets of our process and research dictate each investment. We are willing to think differently than other investors. Our identification of key traits is also repeatable throughout financial ratio analysis, supported by an understanding of business and market cycles.

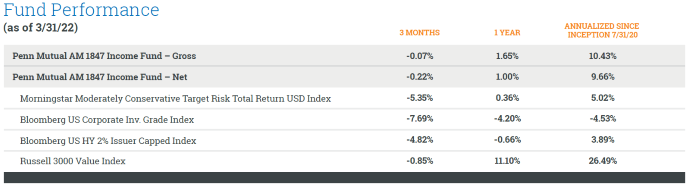

Performance for PMEFX

It is hard to believe that the Fund already has a track record of almost two years. During this time, we have witnessed some incredible, impactful events that will be long remembered. The Fund’s process has been tested and proven in the face of both a wild historic market rally from the pandemic-induced lows and now a major shift in Federal Reserve (Fed) policy along with the threat of global war. Over this time, PMEFX has performed well on the upside — producing a 9.78% return in 2021 and finishing in the 20th percentile out of 479 funds in its Allocation – 30% to 50% Equity Morningstar category as of March 31, 2022. So far in 2022, PMEFX has performed even better on a relative basis as the markets have faced significant losses. We are proud to report that the same holds true with the varying and unprecedented market conditions experienced since the Fund’s inception.

No one knows for certain what the performance of the market will be over any period. The good thing is that we do not need to know. As famed investor Ben Graham once said, “The purpose of the margin of safety is to render the forecast unnecessary.” The flexible approach of our investment process, along with its ability to find a margin of safety, will lead the way. What we need to know is that by executing our process well, the Fund will have a good chance to succeed over a full market cycle — being discriminant with each security selected, deploying capital prudently when there is opportunity and waiting until value is clearly available.

These investment results are driven by the constant pursuit of achieving as much return as possible relative to the risk assumed in each security. Accurately assessing risk and reward at the individual security level should help temper risk on an overall portfolio level in down markets, while still providing the Fund the opportunity to post solid gains in up markets.

Current Positioning for PMEFX

Our bottom-up view has led the Fund to an increasingly conservative positioning throughout 2021. Cash increased from 3% at the beginning of 2021 to nearly 20% by the end of the year. Again, not knowing how world events would transpire in 2022. Although, it was clear that the underlying factors driving huge sales and earnings gains in 2021 seemed stretched and had the potential to slow down. Federal government stimulus was rolling off, the Fed’s easy monetary policy was about to shift and input costs across many line items (commodities, shipping, wages) were increasing. Fewer and fewer companies were responsible for moving the broad indexes higher and many mid- and smaller-capitalization companies were experiencing declining share prices. Overall, we saw a combination of higher risk and poor potential reward. These views developed by our bottom-up research led to an increase in cash and a decrease in overall investments — but particularly an underweight of bonds, especially longer-duration bonds.

For the remainder of 2022, we will continue to be both patient and diligent. Having extra liquidity and cash during volatile markets is not trash. Instead, it is a valuable tool, allowing the Fund to potentially avoid losses while having the necessary capital to take advantage of the market’s mistakes and any opportunities that become available. We have trained ourselves to avoid being emotional even when the markets go a little crazy. Being optimistic or pessimistic is not nearly as important as being realistic. When there appears to be a mountain of worry or concern in the markets…patience, diligence and maybe even a little faith will help us, as Billy Penn said, remove it for PMEFX and its shareholders.

Total Fund Operating Expense: 0.65% Net* 1.83% Gross; *Fee waivers are contractual and in effect until May 31, 2022.

Performance data shown represents past performance and is not a guarantee of future results. Investment performance and principal value will fluctuate, so when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please call 877-PMA-MLLC (877-762-6552).

About PMAM

With over $33 billion in assets under management as of March 31, 2022, Penn Mutual Asset Management ("PMAM") is an institutional asset management firm located just outside of Philadelphia, PA that has been offering investment solutions and client-focused services since 1989.

For more information on the Fund, contact Chris Fanelli, managing director, business development, at fanelli.chris@pennmutualam.com or (609) 306-7034.

Follow the latest news and insights from the PMAM investment team on our Blog as well as on Linkedin and Twitter.

To download a copy, please see the attachment below.

Important Information

The information contained herein has been prepared solely for informational purposes. It is subject to change without notice and it is not intended as an offer or solicitation of the Funds nor any other products or services offered by PMAM. Please note this information has been prepared as a general summary without consideration of any specific investors, thus please do not use this material solely to make any investment decisions. All investors should always refer to the prospectus to learn more about the Fund before investing.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For the full prospectus, which contains this and other information about the Fund, please visit www.pennmutualam.com. Investors should read the prospectus carefully before investing.

The Fund is distributed by SEI Investments Distribution Co. (SIDCO) at 1 Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with Penn Mutual Asset Management. Investing involves risk, including possible loss of principal. The Fund’s other investment risks include, but are not limited to, interest rate, inflation, credit and default risk associated with fixed income securities. In addition, high yield bonds have a higher risk of default or other adverse credit events. Other risks include, but are not limited to, equity risk, preferred stock risk, allocation risk, conflicts of interest risk, counterparty credit risk, foreign investments risk, high portfolio turnover risk, liquidity risk and volatility risk. There is no guarantee the Fund will achieve its stated objective.

Morningstar Moderately Conservative Target Risk Total Return USD Index - The Morningstar Target Risk Index family is designed to meet the needs of investors who would like to maintain a target level of equity exposure through a portfolio diversified across equities, bonds and inflation-hedged instruments. The Morningstar Moderately Conservative Target Risk Index seeks approximately 40% exposure to global equity markets.

Bloomberg U.S. Corporate Investment Grade Index - An index that measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

Bloomberg U.S. High Yield 2% Issuer Capped Index - An issuer-constrained version of the flagship US Corporate High Yield Index, which measures the USD-denominated, high yield, fixed-rate corporate bond market. The index follows the same rules as the uncapped version, but limits the exposure of each issuer to 2% of the total market value and redistributes any excess market value index-wide on a pro-rata basis.

Russell 3000 Value Index - An index that measures the performance of the broad value segment of the US equity value universe. It includes those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values.

2022 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Rankings are historical and are based on total returns.

All investors should consider the investment objectives, risks, charges and expenses carefully before investing. For the full prospectus, which contains this and other information about the Funds, please call 877-PMA-MLLC (877-762-6552) or visit www.pennmutualam.com. Investors should read the prospectus carefully before investing.

The Funds are distributed by SEI Investments Distribution Co. (SIDCO, 1 Freedom Valley Drive, Oaks, PA 19456), which is not affiliated with Penn Mutual Asset Management, LLC, or any of its affiliates.

Important Risks: An investment in the Fund involves risk, including possible loss of principal value. The Fund's other investment risks include, but are not limited to, interest rate, inflation, credit and default risk associated with fixed income securities. In addition, high yield bonds have a higher risk of default or other adverse credit events. Other risks include, but are not limited to, equity risk, preferred stock risk, allocation risk, conflicts of interest risk, counterparty credit risk, foreign investments risk, high portfolio turnover risk, liquidity risk and volatility risk. See “Principal Risks” in the prospectus for a detailed discussion of these and other risks applicable to the Fund. There is no guarantee the Fund will achieve its stated objective.