Mid-Year Economic and Capital Markets Review & Outlook

July 18, 2023

.jpg)

Mid-Year Review

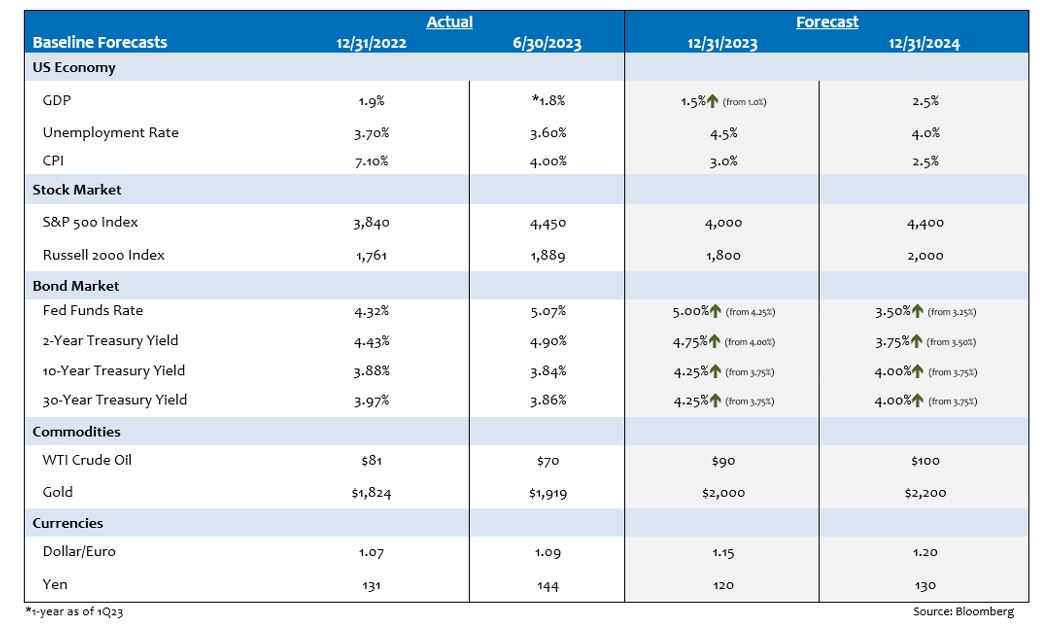

The U.S. economy and financial markets continued to show surprising resilience defying pessimistic projections at the start of the year. Near record tight labor market conditions coupled with excess household savings accumulated during the pandemic continue to push out recession forecasts — now into 2024. In just one sign of the overly negative economic forecasts, the May employment report posted monthly job gains above the consensus estimate for the 14th consecutive month.1 U.S. economic growth for the first half of the year is likely to come in near the 2% level with strength in the service sector more than offsetting a downturn in manufacturing activity.

On the inflation front, trends are improving, but consumer price inflation remains elevated at levels well above the Federal Reserve’s (Fed) 2% target. The most recent annual print for the Fed’s preferred inflation gauge — core Personal Consumption Expenditures (PCE) — came in at 4.6% for May, equal to the reading at the end of 2022.2 Lower energy prices since the beginning of the year have contributed to more significant declines in headline measures of consumer price inflation.

Financial market performance also exceeded expectations this year in the face of ongoing Fed rate hikes, stress in the banking sector beginning with the failure of Silicon Valley Bank in March and a government debt ceiling drama resolved at the last minute. Large-cap technology names resumed their leadership position in equities gaining roughly $5 trillion in value over the first half of 2023.3 Investor enthusiasm for the potential of artificial intelligence in the years ahead pushed valuations to levels reminiscent of the 1999 dot-com bubble.

Despite volatility gradually leaving the equity market this year, interest rate volatility approached the highest levels since the global financial crisis.4 Investors flocked to safety in early March as fears of contagion in the banking system emerged following the almost immediate collapse of Silicon Valley Bank. Fears of a replay of the global financial crisis led to a quick reversal in bearish Treasury bond positioning. In just over two weeks, two-year Treasury note yields plunged 130 basis points from Mar. 8 to Mar. 24.5 Corporate credit spreads also were volatile during the first half of the year but both investment grade and high yield corporate bonds outperformed duration-matched Treasuries for the six-month period.

Outlook

After failing to understand the depth of the inflation problem well after price pressures surfaced in 2021, the Fed remains stuck in a position making price stability its number one priority. Fed policymakers need to see some softening in labor market conditions as a first sign that the current pause in rate hikes can become permanent.

Financial assets have likely fast-forwarded price gains during the first half of the year, with more gains almost certain to bring another round of Fed tightening into play. Credit conditions are likely to become more challenging during the second half of the year as tighter bank lending standards and higher borrowing costs put more pressure on corporate credit fundamentals already showing signs of deterioration.

For timely perspectives on the economy, markets and investing, be sure to subscribe to our market insights blog below.

Sources:

1Seeking Alpha – 14 Straight Beats: May U.S. Jobs Report Quiets The Recession Crowd, VO A Hold; 6/2/23

2Bureau of Economic Analysis – Personal Income and Outlays, May 2023; 6/30/23

3Fortune – Nasdaq had its best ever first-half of the year with a nearly 40% gain propelled by Big Tech and A.I. hype; 6/30/23

4Russell Investments – What investors need to know about the surge in interest rate volatility; 6/12/23

5U.S. Department of the Treasury – Daily Treasury Par Yield Curve Rates; as of 7/7/23

Index Definitions:

S&P 500 Index — An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large-cap universe.

Russell 2000 Index — An index measuring the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is comprised of 3,000 of the largest U.S. stocks.

All trademarks are the property of their respective owners.

Disclosures:

The views expressed in this material are the views of PMAM through the year ending June 30, 2023, and are subject to change based on market and other conditions. This material contains certain views that may be deemed forward-looking statements. The inclusion of projections or forecasts should not be regarded as an indication that PMAM considers the forecasts to be reliable predictors of future events. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate. Actual results may differ significantly.

Past performance is not indicative of future results. The views expressed do not constitute investment advice and should not be construed as a recommendation to purchase or sell securities. All information has been obtained from sources believed to be reliable, but accuracy is not guaranteed. There is no representation or warranty as to the accuracy of the information and PMAM shall have no liability for decisions based upon such information.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.