2024 Economic and Capital Markets Outlook

January 10, 2024

.jpg)

As we embark upon a new year, the entire PMAM team would like to extend our sincere wishes for a healthy and prosperous 2024. Following a year filled with unexpected twists and turns in both the economy and markets, the foremost question on investors' minds is whether 2024 will usher in a level of stability not witnessed since the onset of the pandemic.

The stage for the 2024 economic and financial market outlook underwent a dramatic shift in the final two months of 2023. The Federal Reserve's (Fed) pivot, marking not only the conclusion of its rate-hiking cycle but also advancing the timeline for potential interest rate cuts, sparked a historic year-end rally across nearly all financial assets. This Fed U-turn is anticipated to exert a meaningful influence on the performance of the economy and markets in the coming year.

Beginning with the economic outlook, the prospect of a more accommodative Fed has already led to a rapid easing of financial conditions. According to the St. Louis Fed Financial Stress Index, current financial conditions are more favorable than when the Fed initiated rate hikes in March 2022.1 Sectors that bore the brunt of the bond bear market, namely banking and housing, should begin to reap the benefits of lower interest rates.

While the prolonged inversion of the Treasury yield curve often rings recession alarm bells, the more powerful forces sustaining U.S. economic growth appear to be the friendlier Fed and full employment. A return to the "Goldilocks" growth environment appears increasingly likely, with the service sector showing signs of softness while the goods sector displays indications of a rebound. Consumer balance sheets are also benefiting from the year-end equity rally and sustained high home prices.

The primary risk stemming from the Fed's shift to easier monetary policy is the potential for a more challenging inflationary environment. With tight labor markets keeping upward pressure on wages, achieving the Fed's 2% inflation target may prove more difficult than anticipated. The Fed cannot afford another policy mistake after underestimating inflation in 2021, prompting Chair Jerome Powell to retire the term "transitory."

Interest rates will again play a crucial role in forecasting financial market performance this year. The interest rate landscape for 2024 is likely to be determined by a tug of war between a more accommodative Fed and a significant increase in Treasury bond issuance. The Fed's decision to abandon its commitment to "higher for longer" interest rates may have in part been influenced by disappointing results from a string of Treasury long bond auctions beginning in August. We expect the upward pressure on rates from new issuance will ultimately drive longer-term interest rates higher by the end of the year. The yield curve — now entering its 15th consecutive month of inversion — should normalize (i.e. short-term yields below longer maturity yields) as the Fed begins to cut rates.2

The Magnificent 7 — Alphabet, Amazon, Apple, Microsoft, Netflix, Nvidia and Tesla — will continue to be a key driver of broad equity index levels during 2024. However, beyond these seven companies, the broader stock market must navigate two key factors in 2024: the expectation for lower inflation and interest rates as well as the rationale behind this decline. Some companies are beginning to feel the lagged effect of sharply higher interest rates, grappling with increased borrowing costs and lower demand. However, if higher prices continue to trend downward without a proportional decline in growth, it could bode well for stock prices and valuations. Nonetheless, interest rate sensitivity remains elevated, and a return of the “higher for longer” interest rate narrative could place pressure on highly leveraged companies.

Corporate credit markets also remained extraordinarily resilient through numerous challenges during 2023, finishing the year near the tightest spread levels since the Global Financial Crisis. The ability of U.S. corporations to take advantage of ultra-low borrowing costs before the Fed’s rate-hiking campaign and strong demand for yield have been key drivers supporting valuations. We expect corporate credit fundamentals to soften with spreads widening modestly this year as the euphoria surrounding the Fed’s pivot gradually fades. We will continue to favor high-quality corporate bonds well positioned to manage through a full economic cycle while opportunistically taking advantage of market volatility.

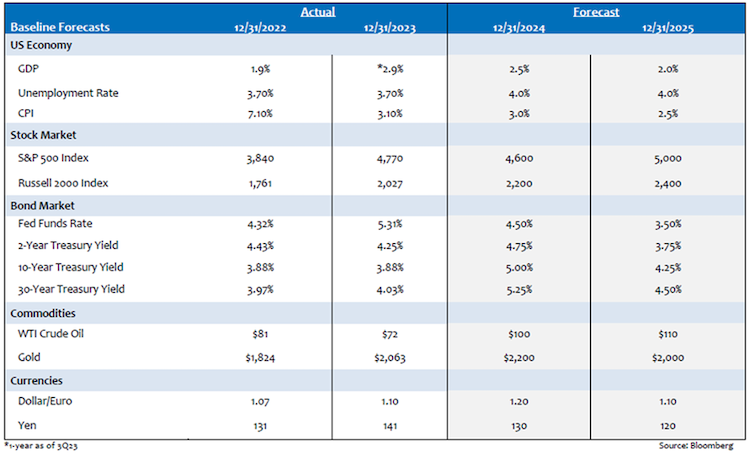

Exhibit 1. 2022 and 2023 Actual; 2024 and 2025 Forecasts

To read our 2023 market and economic year-in-review, click here.

For timely perspectives on the economy, markets and investing, be sure to subscribe to our market insights blog below.

Sources:

1Federal Reserve Bank of St. Louis – St. Louis Fed Financial Stress Index; January 2024

2Bloomberg – 3-Month Treasury Bills to 10-Year Treasury Note; January 2024

Index Definitions:

S&P 500 Index — An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large-cap universe.

Russell 2000 Index — An index measuring the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is comprised of 3,000 of the largest U.S. stocks.

All trademarks are the property of their respective owners.

Disclosures:

The views expressed in this material are the views of PMAM through the year ending December 31, 2023, and are subject to change based on market and other conditions. This material contains certain views that may be deemed forward-looking statements. The inclusion of projections or forecasts should not be regarded as an indication that PMAM considers the forecasts to be reliable predictors of future events. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate. Actual results may differ significantly.

Past performance is not indicative of future results. The views expressed do not constitute investment advice and should not be construed as a recommendation to purchase or sell securities. All information has been obtained from sources believed to be reliable, but accuracy is not guaranteed. There is no representation or warranty as to the accuracy of the information and PMAM shall have no liability for decisions based upon such information.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.