2024 Economic and Market Review

January 10, 2025

.jpg)

As we enter 2025, the PMAM investment team reflects on 2024, summarizing notable economic and financial market themes that occurred throughout the year.

ECONOMIC GROWTH & INFLATION

The U.S. economy continues to show surprising resilience two and a half years after the Federal Reserve (Fed) started tightening monetary policy.1 Economic forecasters, including those inside the Fed, have consistently underestimated the strength of the U.S. economy since the first rate hike. Gross domestic product during 2024 is likely to come in near 3%, more than double the rate projected by Fed policymakers at the start of the year. U.S. consumers, refusing to buy into the economic slowdown narrative, remain willing and able to spend. Following a 3.7% advance during the third quarter — the fastest growth since early 2023 — consumer spending is expected to show solid growth again in the fourth quarter.2

The U.S. labor market, arguably the last segment of the economy to normalize coming out of the pandemic, moved into better balance as the year progressed. Job openings in the U.S. steadily declined this year, returning to pre-pandemic levels, while the number of unemployed workers increased.3

An uptick in the unemployment rate during 2024 stirred fears of a more severe downturn in the job market. A recently introduced recession indicator, the Sahm rule, started to make financial news headlines when the unemployment rate hit 4.0%. The rule states when the three-month average unemployment rate increases by more than 0.50% above its recent 12-month low, a recession is likely. The Sahm rule was triggered in July when the unemployment rate increased to 4.3%.4

The favorable inflation trends entering 2024 came to an abrupt halt during the first quarter.5 A string of disappointing inflation readings pushed Treasury yields higher as investors scaled back their expectations for Fed rate cuts this year. Fed Chair Powell labeled the inflation upturn as likely a bump in the road on the path to the Fed’s 2% inflation target.6 More encouraging inflation data started to re-emerge in May with a material decline in energy and agriculture commodity prices more than offsetting stubbornly high housing costs. Fed policymakers welcomed the improving inflation news, bringing more “confidence that inflation was moving toward the Committee’s objective.”7

MONETARY & FISCAL POLICY

Following its September meeting, the Fed announced its first interest rate cut since March 2020,8 lowering its policy rate by 50 basis points (bps) and slashing forward interest rate projections in its September “dot plot.”9 Growing concerns regarding the health of the labor market factored into the Fed’s decision to opt for the larger rate cut. During his post-meeting press conference, Fed Chair Powell expressed concern the monthly payroll estimates were “artificially high.”10 The annual revision by the Bureau of Labor Statistics (BLS) showed job growth was nearly 30% less than initially reported from April 2023 to March 2024.11

While equity and credit markets rallied strongly after the “super-sized” rate cut, the bond market did not share in the exuberance. Longer-term Treasury bond yields rose steadily after mid-September, moving above the 4.5% mark by election day.12 Bond investors appeared more in agreement with the one dissenting vote from Fed Governor Bowman, who argued more work needed to be done to bring inflation back to target.13

The Federal Open Market Committee (FOMC) voted to further lower rates by 25 bps during both its November and December meetings.14 The November interest rate cut was overshadowed by the Republican sweep on election day which led to an immediate surge in interest rates and inflation expectations.

Despite the risks of more expansionary fiscal policies under President-elect Trump’s incoming administration re-igniting inflation, Fed Chair Powell suggested the election would have “no effects on our policy decisions” during his post-meeting press conference.15 Fed policymakers reduced their forecast for interest rate cuts next year with inflation projected to show little progress moving toward the Fed’s 2% target.

The Trump Administration’s policy agenda is likely to create a strong fiscal impulse, including an extension of the 2017 Tax Cuts & Jobs Act. However, more uncertainty surrounds the incoming administration’s ability to deliver on a host of other campaign promises, including the elimination of taxes on tips, overtime and Social Security payments. With a narrow Republican majority in the House of Representatives, the Trump Administration will need to convince fiscal hawks within the Republican Party that the proposed tax cuts will not blow up the deficit.

INTEREST RATES & CREDIT

After the bond market closed 2023 with the strongest two-month performance in decades,16 interest rates reversed course during the first four months of 2024. Bond investors were forced to reevaluate overly optimistic projections for Fed rate cuts this year. Shorter-term interest rates led the rate move higher with the 2-year Treasury note yield hitting the 5% mark by late April.17 The yield curve also moved deeper into inversion.

Treasury yields peaked in late April with headline inflation readings easing again during May and June. Signs of softening labor market conditions, including the unemployment rate moving above 4% in June,18 put a September Fed rate cut back on the table. The bond rally gathered steam heading into the third quarter with more disappointing labor market news, most notably the BLS annual benchmark revision showing 818,000 fewer jobs created than originally published.19 10-year Treasury yields touched a low for the year of 3.62% prior to the Fed’s September meeting, more than 100 bps below its April peak.20 The record-long Treasury yield curve inversion (as measured between the 2-year and 10-year Treasury) came to an end in early September.21

The bond market’s response to 100 bps of total rate cuts was clearly not what the Fed was anticipating with Treasury yields moving higher across the curve afterward. Markets started to price in higher inflation risks ahead as part of the so-called “Trump Trade.” With home price affordability measures near the most challenging on record, the recent pick-up in mortgage rates back above the 7% level brought more disappointment for homebuyers hoping for help from the Fed pivot.22

Despite periodic bouts of volatility across equities and interest rates during the year, credit markets held steady with spreads gradually moving tighter as the year progressed. Investment-grade (IG) credit spreads recently broke through levels not seen since the 1990s. 2024 was the second busiest on record for IG corporate bond issuance but demand has more than kept pace, especially at the long end of the yield curve.

Another theme across all credit spread sectors this year has been strong outperformance for lower-rated investments. CCC-rated corporate debt, BB-rated collateralized loan obligations, and BBB-rated commercial mortgage-backed securities have all posted low- to mid-teen total returns during the year, well in excess of higher-rated spread assets. Government agency residential mortgage-backed securities posted modest outperformance relative to the returns for duration-matched Treasuries.

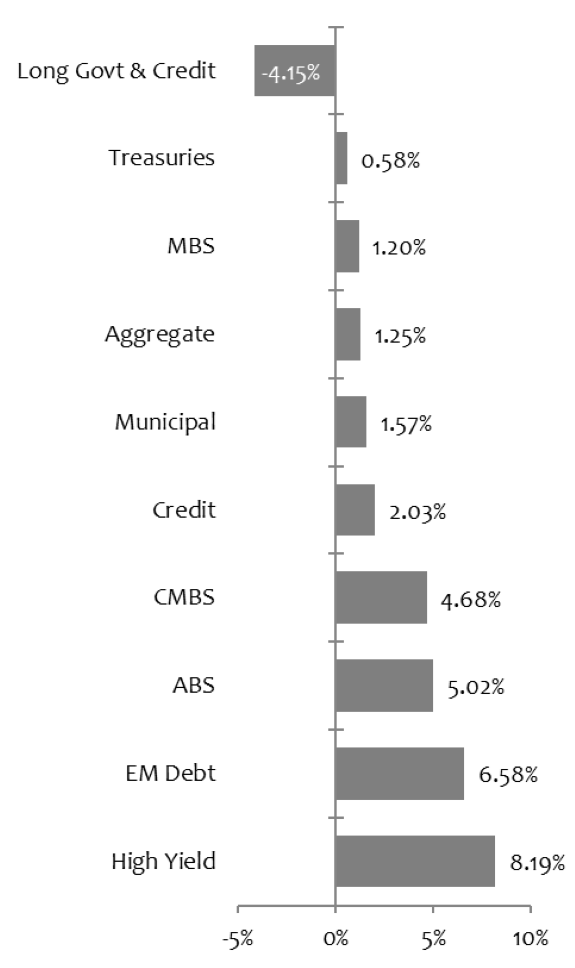

Exhibit 1. 2024 Bond Market Performance

Source: Bloomberg Data as 12/31/24

EQUITY MARKETS

Equity markets in 2024 performed exceptionally well. In contrast to 2023 when the market performance was extremely concentrated, equity returns across market capitalizations (caps) and sectors broadened out. The large cap growth-focused Magnificent Seven stocks still led the way, but value sectors like utilities and financials generated returns above 20%.23 The encouraging news is that corporate earnings growth was generally solid, providing support for stock prices. The market grew into its valuation for the most part, with dynamic factors like artificial intelligence impacting traditionally conservative sectors such as utility companies, due to a dramatic increase in energy demand.

The markets faced several challenges over the past 12 months, the most significant being a volatility-spike-induced drawdown caused by the brief unwind of the Japanese Yen carry trade. However, each setback during the year was quickly followed by an even greater rally.

The S&P 500 Index set 57 new record highs during the year but closed 2024 on a weaker note.24 The S&P 500 Index registered a total return of approximately 25% during 2024,25 well above the average target level set by Wall Street analysts at the beginning of the year. The decisive victory by the Republican Party helped to keep animal spirits strong. Investors expect a more regulatory- and business-friendly environment will enable companies to continue delivering on lofty earning expectations. The greatest risk to the equity rally is a reigniting of inflation and a subsequent rise in interest rates.

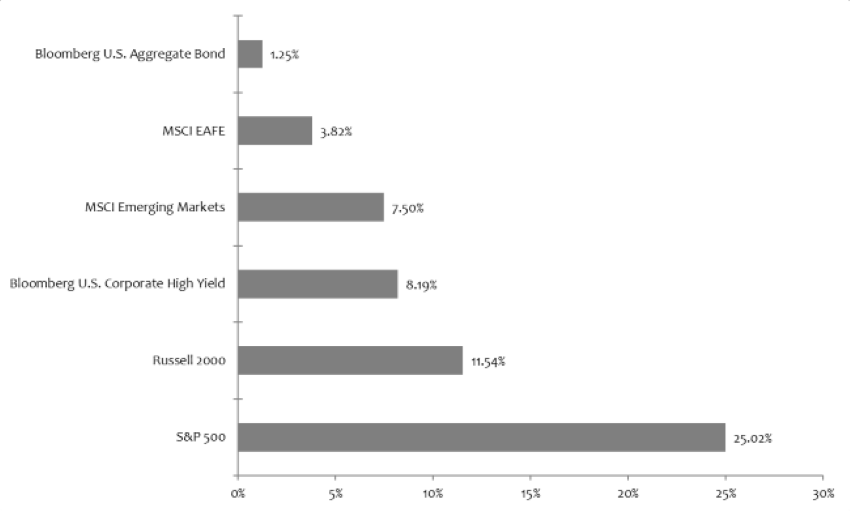

Exhibit 2. 2024 Financial Market Performance

Source: Bloomberg Data as 12/31/24

Now that 2024 has come to an end, what can investors expect in 2025? Be sure to check back next week for our 2025 Economic and Capital Markets Outlook.

Sources:

1CNBC – Federal Reserve approves first interest rate hike in more than three years, sees six more ahead; 3/16/22

2U.S. Department of Commerce – Commerce Data Show Strong Economic Gains Due to Americans Making and Spending More; 11/4/24

3FRED Economic Data – Job Openings: Total Nonfarm; November 2024

4Barron’s – Rising Unemployment Rate Triggers Sahm Rule Recession Indicator; 8/5/24

5,6Federal Reserve Board – Transcript of Chair Powell’s Press Conference March 20, 2024

7Federal Reserve Board – Minutes of the Federal Open Market Committee July 30–31, 2024

8,9CNBC – Fed slashes interest rates by a half point, an aggressive start to its first easing campaign in four years; 9/18/24

10Federal Reserve Board – Transcript of Chair Powell’s Press Conference September 18, 2024

11,19CNBC – Nonfarm payroll growth revised down by 818,000, Labor Department says; 8/21/24

12,17U.S. Department of the Treasury – Daily Treasury Par Yield Curve Rates; 2024

13Reuters – Fed Bowman's dissent is first from Fed governor since 2005; 9/18/24

14CBS News – Federal Reserve made a 3rd consecutive rate cut today. Here's how it will impact your money; 12/18/24

15Federal Reserve Board – Transcript of Chair Powell’s Press Conference November 7, 2024

16Reuters – Biggest two-month rally in decades rescues beaten-up bond markets; 12/29/23

18Trading Economics – United States Unemployment Rate; 2024

20CNBC – 10-Year Treasury Yield; as of 9/16/24

21CNBC – Bond market ‘yield curve’ returns to normal from inverted state that had raised recession fears; 9/4/24

22Bankrate – Mortgage rates back over 7%; 12/31/24

23Morningstar Direct; as of 12/31/24

24CNBC – CNBC Daily Open: S&P 500 soared in 2024 despite a weak fourth quarter; 1/1/25

25Bloomberg

Index Definitions:

Bloomberg U.S. Aggregate ABS Total Return Index – An index that is the ABS component of the U.S. Aggregate Index and has three subsectors: credit and charge cards, autos and utility. The index includes pass-through, bullet and controlled amortization structures and includes only the senior class of each ABS issue and the ERISA-eligible B and C tranche.

Bloomberg U.S. Aggregate Bond Index – An index that is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

Bloomberg U.S. CMBS Index – An Index that measures the investment-grade market of U.S. Agency and U.S. Non-Agency conduit and fusion CMBS deals with a minimum current deal size of $300mm that are ERISA eligible.

Bloomberg U.S. Corporate High Yield Bond Index – An index that measures the USD-denominated, high yield, fixed-rate corporate bond market.

Bloomberg U.S. Credit Index – An index that measures the investment grade, U.S. dollar-denominated, fixed-rate, taxable corporate and government-related bond markets.

Bloomberg Emerging Markets USD Aggregate Index – A flagship hard currency Emerging Markets debt benchmark that includes fixed and floating-rate U.S. dollar-denominated debt issued from sovereign, quasi-sovereign and corporate EM issuers.

Bloomberg U.S. Long Government/Credit Index – An index that is a broad-based flagship benchmark that measures the non-securitized component of the U.S. Aggregate Index with 10 or more years to maturity. The index includes investment grade, U.S. dollar-denominated, fixed-rate treasuries, government-related and corporate securities.

Bloomberg U.S. Mortgage-Backed Securities (MBS) Index – An index that tracks agency mortgage-backed pass-through securities (both fixed-rate and hybrid ARM) guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA) and Freddie Mac (FHLMC).

Bloomberg U.S. Municipal Index – An index that covers the USD-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligations bonds, revenue bonds, insured bonds and prerefunded bonds.

Bloomberg U.S. Treasury Index – An index that measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury.

MSCI EAFE Index – An index that is designed to measure the equity market performance of developed markets outside of the U.S. & Canada.

MSCI Emerging Markets Index – A free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

Russell 2000 Index – An index measuring the performance of approximately 2,000 small cap companies in the Russell 3000 Index, which is comprised of 3,000 of the largest U.S. stocks.

S&P 500 Index – An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe.

All trademarks are the property of their respective owners.

Disclosures:

The views expressed in this material are the views of PMAM through the year ending December 31, 2024, and are subject to change based on market and other conditions. This material contains certain views that may be deemed forward-looking statements. The inclusion of projections or forecasts should not be regarded as an indication that PMAM considers the forecasts to be reliable predictors of future events. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate. Actual results may differ significantly.

Past performance is not indicative of future results. The views expressed do not constitute investment advice and should not be construed as a recommendation to purchase or sell securities. All information has been obtained from sources believed to be reliable, but accuracy is not guaranteed. There is no representation or warranty as to the accuracy of the information and PMAM shall have no liability for decisions based upon such information.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.