2025 Economic & Market Outlook

January 15, 2025

As we embark upon a new year, the entire PMAM team would like to extend our sincere wishes for a healthy and prosperous 2025. Following a year marked by the continued strength of the U.S. economy, magnificent returns for the S&P 500 Index and the long-anticipated start of Federal Reserve (Fed) rate cuts, investors are understandably questioning how much longer the good times can keep rolling. U.S. exceptionalism, which has generally been the rule for both the economy and markets since the Global Financial Crisis, raises the bar higher every year for continued outperformance. U.S. equity and credit market valuations are currently pricing in strong earnings growth, stable credit conditions and more accommodative monetary policy.

Even though Fed Chair Powell continues to argue that monetary policy remains “meaningfully restrictive,”1 patience is likely to be the operative word for Fed policymakers during the upcoming year. New policy initiatives under the Trump Administration are likely to boost economic growth but also increase the risk of re-igniting inflation. The material rise in long-term Treasury yields and inflation expectations during the past few months seems to be a clear signal the Fed’s job to maintain price stability is not finished.2

The immediate equity and credit market reaction to Trump’s decisive presidential election win was overwhelmingly positive despite the upward pressure on interest rates. The biggest challenge for risk markets moving forward is higher interest rates, and inflation expectations eventually will weigh on valuations for all financial assets. In the words of Warren Buffett, “(High) interest rates are to asset prices…like gravity is to the apple.”3

The recent increase in Treasury yields at the start of an easing cycle is also a warning for fiscal policymakers. Moody’s warning after the Republican sweep on election day that “risks to U.S. fiscal strength have increased” may lead to a downgrade at the last of the major credit rating agencies to maintain a top rating for the U.S.4 A Moody’s downgrade increases the likelihood of a replay of stressed liquidity conditions and weak demand at auctions for Treasury bonds following the Fitch downgrade of the U.S. in August 2023.5

The historic repricing of the bond market, which started three years ago, should continue to present opportunities to invest in high-quality fixed-income assets at the most attractive levels in nearly two decades. Normalization of the Treasury yield curve should increase opportunities to add value through active fixed-income management. Our opportunistic, relative-value-based approach should continue to benefit results for our clients as we navigate markets where high interest rate volatility is likely to spill over more broadly to financial market volatility.

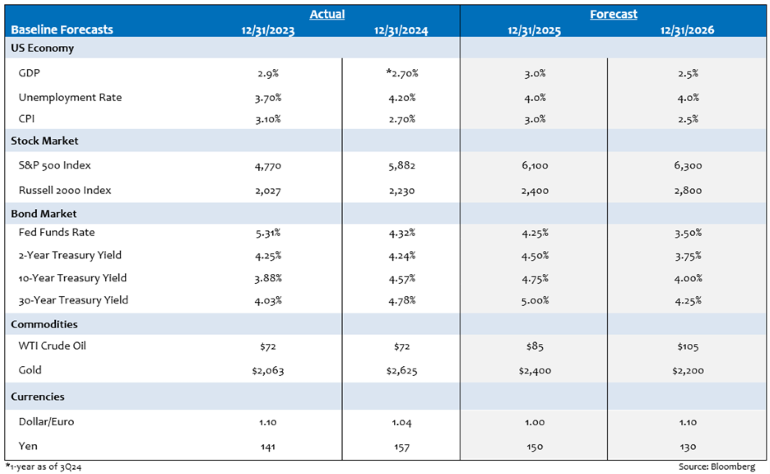

Exhibit 1. 2023 and 2024 Actual; 2025 and 2026 Forecasts

To read our 2024 market and economic year-in-review, click here.

For timely perspectives on the economy, markets and investing, be sure to subscribe to our market insights blog below.

Sources:

1Federal Reserve Board – Transcript of Chair Powell’s Press Conference December 18, 2024

2J.P. Morgan Asset Management – Interest Rates, Inflation and the Uncertainty Tax; 1/13/25

3Warren Buffett Archive – Morning Session - 2013 Meeting; 5/4/13

4Reuters – US fiscal health risks increase after Trump election, says Moody's; 11/8/24

5Fitch Ratings – Fitch Downgrades the United States' Long-Term Ratings to 'AA+' from 'AAA'; Outlook Stable; 8/1/23

Index Definitions:

S&P 500 Index — An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large-cap universe.

Russell 2000 Index — An index measuring the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is comprised of 3,000 of the largest U.S. stocks.

All trademarks are the property of their respective owners.

Disclosures:

The views expressed in this material are the views of PMAM through the year ending December 31, 2024, and are subject to change based on market and other conditions. This material contains certain views that may be deemed forward-looking statements. The inclusion of projections or forecasts should not be regarded as an indication that PMAM considers the forecasts to be reliable predictors of future events. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate. Actual results may differ significantly.

Past performance is not indicative of future results. The views expressed do not constitute investment advice and should not be construed as a recommendation to purchase or sell securities. All information has been obtained from sources believed to be reliable, but accuracy is not guaranteed. There is no representation or warranty as to the accuracy of the information and PMAM shall have no liability for decisions based upon such information.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.